The Business and Financial Forum CIBC.RBC-RoyalBank.TD-CanadaTrust.BMO.ScotiaBank.

Consolidating debt? Good business tips? Buying stock? How's our economy doing? Discuss and share advice and tools on everyday banking, investing, wealth management and insurance.. |

| |  01-20-2022, 09:45 PM

01-20-2022, 09:45 PM

|

#11401 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,913

Thanked 5,857 Times in 2,828 Posts

Failed 315 Times in 156 Posts

|

^ wow ... let's hope you're right and it pulls up AARK. Cathie Woods and AARK has been tanking so bad lately!

|

|  |  01-21-2022, 01:30 AM

01-21-2022, 01:30 AM

|

#11402 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2013 Location: revscene

Posts: 5,016

Thanked 5,441 Times in 1,931 Posts

Failed 180 Times in 78 Posts

| Quote:

Originally Posted by donk.  I have xx,xxx$ with a company group RRSP (pi financial / ci investments)

Over the past 6 years, it's been an average of 2.3% return

Where would you transfer this for better returns? Company wise.

I'm not interested in self gambling on my RBC investment account, I'm guaranteed to buy shit pink slips and risky stonks. I have two grand in there with play money, and 80% of it is in the red lol..... minus the MVIS pump and dump that I cashed in. | I was gonna have PI financial handle my private placement shares and stuff until I found this https://biv-com.cdn.ampproject.org/v...mstances-iiroc

Sent from my SM-G781W using Tapatalk

__________________

|| 18 FK8 | R-18692 | Rallye Red | 6 MT ||

|| SOLD 97 E36 M3 Sedan | Arctic Silver | 5MT ||

|| RIP 02 E46 330ci | Schwartz Black II | 5MT | M-Tech II | Black Cube | Shadowline | Stoff Laser/Anthrazit ||

|| RIP 02 E46 M3 | Carbon Black | 6MT ||

|

|  |  01-21-2022, 09:31 AM

01-21-2022, 09:31 AM

|

#11403 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

| Quote:

Originally Posted by whitev70r  ^ wow ... let's hope you're right and it pulls up AARK. Cathie Woods and AARK has been tanking so bad lately! | I feel like TSLA is the biggest risk reward play besides crypto.

I truly believe in the company and their vision.

I hope i'm right too.. lol

If it goes south, my wife has her portfolio which is all index funds and she has a government pension, so we'll be fine =)

|

|  |  01-21-2022, 09:38 AM

01-21-2022, 09:38 AM

|

#11404 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,913

Thanked 5,857 Times in 2,828 Posts

Failed 315 Times in 156 Posts

|

I'm just a jealous outsider who didn't get in on TSLA early and now it's way too expensive.

So I make disparaging comments about the fluky nature of Musk ... and how he manipulates stock prices ... haha.

|

|  |  01-24-2022, 08:38 AM

01-24-2022, 08:38 AM

|

#11405 | | Willing to sell body for a few minutes on RS

Join Date: Oct 2005 Location: Revscene

Posts: 10,020

Thanked 8,305 Times in 2,798 Posts

Failed 438 Times in 130 Posts

|

Bloody monday. In correction territory now!

__________________ Quote:

Originally Posted by skyxx  Sonick is a genius. I won't go into detail what's so great about his post. But it's damn good! | 2010 Toyota Rav4 Limited V6 - Wifey's Daily Driver

2009 BMW 128i - Daily Driver

2007 Toyota Rav4 Sport V6 - Sold

1999 Mazda Miata - Sold

2003 Mazda Protege5 - Sold

1987 BMW 325is - Sold

1990 Mazda Miata - Sold 100% Buy and Sell Feedback |

|  |  01-24-2022, 08:45 AM

01-24-2022, 08:45 AM

|

#11406 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2013 Location: revscene

Posts: 5,016

Thanked 5,441 Times in 1,931 Posts

Failed 180 Times in 78 Posts

|

Anyone in on MTTR (Matterport)? They've been hyped up a lot in the past few weeks and all I see is red for them. Warrant execution is defs taking a toll on them. Cool company tho

__________________

|| 18 FK8 | R-18692 | Rallye Red | 6 MT ||

|| SOLD 97 E36 M3 Sedan | Arctic Silver | 5MT ||

|| RIP 02 E46 330ci | Schwartz Black II | 5MT | M-Tech II | Black Cube | Shadowline | Stoff Laser/Anthrazit ||

|| RIP 02 E46 M3 | Carbon Black | 6MT ||

|

|  |  01-24-2022, 09:47 AM

01-24-2022, 09:47 AM

|

#11407 | | My homepage has been set to RS

Join Date: Jan 2012 Location: vancouver

Posts: 2,448

Thanked 1,762 Times in 546 Posts

Failed 1,107 Times in 281 Posts

|

good thing we dont need this money any time soon..

|

|  |  01-24-2022, 09:49 AM

01-24-2022, 09:49 AM

|

#11408 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

| Quote:

Originally Posted by whitev70r  I'm just a jealous outsider who didn't get in on TSLA early and now it's way too expensive.

So I make disparaging comments about the fluky nature of Musk ... and how he manipulates stock prices ... haha. | Just bought four more TSLA shares today.

I sold some S&P Index. LETS GOOOOOOOOOOOOOOOOOOOOO

I really feel like you need to get into TSLA. Out of all of the big tech companies, I feel TSLA has the highest growth potential.

Once these supply chain issues abate, the runway is going to be so long. + Austin and Berlin factories are ramping this year, cybertruck coming out, 4680 batteries, possible new sub-compact TSLA in $30k range, + solar/energy/powerback/megapack.

IT'S NOT TOO LATE TO GET IN.

|

|  |  01-24-2022, 10:09 AM

01-24-2022, 10:09 AM

|

#11409 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,913

Thanked 5,857 Times in 2,828 Posts

Failed 315 Times in 156 Posts

|

^ only $897US per ...

Not sure if I should take financial advice from someone I don't know on the internet with the handle PeanutButter but let's see how much cash I have to play with .. .

I tinkered with NIO and XPEV ... small time EV investor.

|

|  |  01-24-2022, 10:21 AM

01-24-2022, 10:21 AM

|

#11410 | | Need to Shave n Shower, but I CANT STOP POSTING ON RS

Join Date: Apr 2007 Location: Okanagan

Posts: 17,504

Thanked 10,316 Times in 4,511 Posts

Failed 435 Times in 233 Posts

|

Wooo a sale. I grabbed more tiddy bang.

__________________ 1991 Toyota Celica GTFour RC // 2007 Toyota Rav4 V6 // 2000 Jeep Grand Cherokee

1992 Toyota Celica GT-S ["sold"] \\ 2007 Jeep Grand Cherokee CRD [sold] \\ 2000 Jeep Cherokee [sold] \\ 1997 Honda Prelude [sold] \\ 1992 Jeep YJ [sold/crashed] \\ 1987 Mazda RX-7 [sold] \\ 1987 Toyota Celica GT-S [crushed] Quote:

Originally Posted by maksimizer  half those dudes are hotter than ,my GF. | Quote:

Originally Posted by RevYouUp  reading this thread is like waiting for goku to charge up a spirit bomb in dragon ball z | Quote:

Originally Posted by Good_KarMa  OH thank god. I thought u had sex with my wife. :cry: | |

|  |  01-24-2022, 10:27 AM

01-24-2022, 10:27 AM

|

#11411 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

| Quote:

Originally Posted by whitev70r  ^ only $897US per ...

Not sure if I should take financial advice from someone I don't know on the internet with the handle PeanutButter but let's see how much cash I have to play with .. .

I tinkered with NIO and XPEV ... small time EV investor. | That's actually smart of you. Don't trust people on the internet.

The hard part about investing in these sorts of stocks is your level of understanding of the company and your conviction. It's all good when the price is going up, but if you're not convicted in the company when the price goes down, there's higher selling pressure.

My friend is invested into Palantir. He's down over 50% and asked if he should sell. I told him I don't know the company at all, but if you do and you're convicted, then don't sell. But, if you don't know anything about the company. you shouldn't have bought the stock in the first place. At least look at their financials, are they even making money?

In regards to TSLA, their potential is huge. Just look out for their earnings coming out this week. They are going to blow out for the quarter.

I'm hoping TSLA will split soon, that way it's easier to buy.

|

|  |  01-24-2022, 10:43 AM

01-24-2022, 10:43 AM

|

#11412 | | Rs has made me the woman i am today!

Join Date: Sep 2006 Location: Vancouver

Posts: 4,170

Thanked 1,361 Times in 594 Posts

Failed 149 Times in 56 Posts

|

I've been putting my money into safer things such as S&P ETF & Banks in Q4 2021, ran up a good 15% ROI, until this past 2 weeks. Blood bath LOL. I plan to hold these long-term, not gonna look at it.

Good time to buy whatever you been eyeing on.

|

|  |  01-24-2022, 10:52 AM

01-24-2022, 10:52 AM

|

#11413 | | Willing to sell body for a few minutes on RS

Join Date: Oct 2005 Location: Revscene

Posts: 10,020

Thanked 8,305 Times in 2,798 Posts

Failed 438 Times in 130 Posts

|

fk, just topped up my RRSP and TFSAs 10 days ago before this correction. Poor timing. Oh well all long-term holds anyway.

__________________ Quote:

Originally Posted by skyxx  Sonick is a genius. I won't go into detail what's so great about his post. But it's damn good! | 2010 Toyota Rav4 Limited V6 - Wifey's Daily Driver

2009 BMW 128i - Daily Driver

2007 Toyota Rav4 Sport V6 - Sold

1999 Mazda Miata - Sold

2003 Mazda Protege5 - Sold

1987 BMW 325is - Sold

1990 Mazda Miata - Sold 100% Buy and Sell Feedback |

|  |  01-24-2022, 11:04 AM

01-24-2022, 11:04 AM

|

#11414 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,913

Thanked 5,857 Times in 2,828 Posts

Failed 315 Times in 156 Posts

| Quote:

Originally Posted by sonick  fk, just topped up my RRSP and TFSAs 10 days ago before this correction. Poor timing. Oh well all long-term holds anyway. | I hate it when that happens! It's happened a couple of times, you think it's low and then boom, 2 weeks later, market is lit with red.

|

|  |  01-24-2022, 11:25 AM

01-24-2022, 11:25 AM

|

#11415 | | RS controls my life!

Join Date: Mar 2012

Posts: 768

Thanked 562 Times in 245 Posts

Failed 62 Times in 18 Posts

| Quote:

Originally Posted by sonick  fk, just topped up my RRSP and TFSAs 10 days ago before this correction. Poor timing. Oh well all long-term holds anyway. | Honestly, you did the right thing. Long-term, Time-in-the-market > Timing-the-market

"We've long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children." - 1992 Berkshire Hathaway Chairman's Letter https://www.berkshirehathaway.com/letters/1992.html |

|  |  01-24-2022, 11:26 AM

01-24-2022, 11:26 AM

|

#11416 | | Say! Say! Say!

Join Date: Aug 2005 Location: Japan

Posts: 15,549

Thanked 3,393 Times in 1,497 Posts

Failed 246 Times in 65 Posts

| Quote:

Originally Posted by sonick  fk, just topped up my RRSP and TFSAs 10 days ago before this correction. Poor timing. Oh well all long-term holds anyway. |

I know that feel bro.

__________________ Quote: | Owner of Vansterdam's 420th thanks. OH YEAUHHH. | Quote:

Originally Posted by 89blkcivic  Did I tell you guys black is my favourite colour? My Ridgeline is black. My Honda Fit is black. Wish my dick was black........ LOL. | |

|  |  01-24-2022, 12:13 PM

01-24-2022, 12:13 PM

|

#11417 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

| Quote:

Originally Posted by GGnoRE  Honestly, you did the right thing. Long-term, Time-in-the-market > Timing-the-market

"We've long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children." - 1992 Berkshire Hathaway Chairman's Letter https://www.berkshirehathaway.com/letters/1992.html | It goes to show, even the great Warren Buffet can't time the market.

His sell order of all his airline stocks during 2020 was probably one of the worst timed trades of all time. The stock position was pretty much the exact low of the year and he sold all of his airline stocks.

|

|  |  01-24-2022, 01:41 PM

01-24-2022, 01:41 PM

|

#11418 | | Say! Say! Say!

Join Date: Aug 2005 Location: Japan

Posts: 15,549

Thanked 3,393 Times in 1,497 Posts

Failed 246 Times in 65 Posts

|

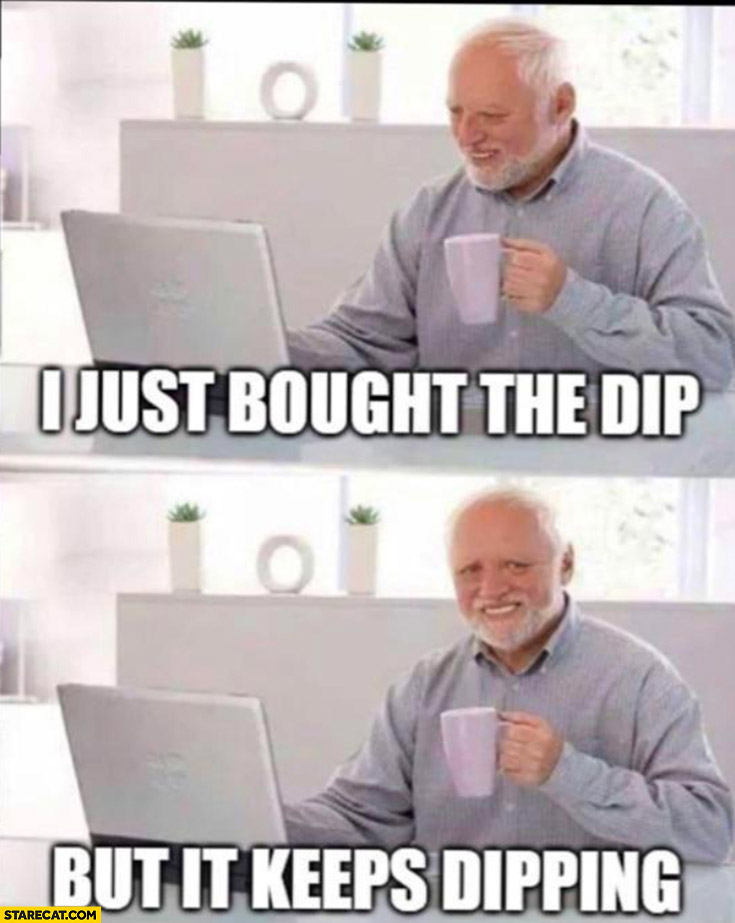

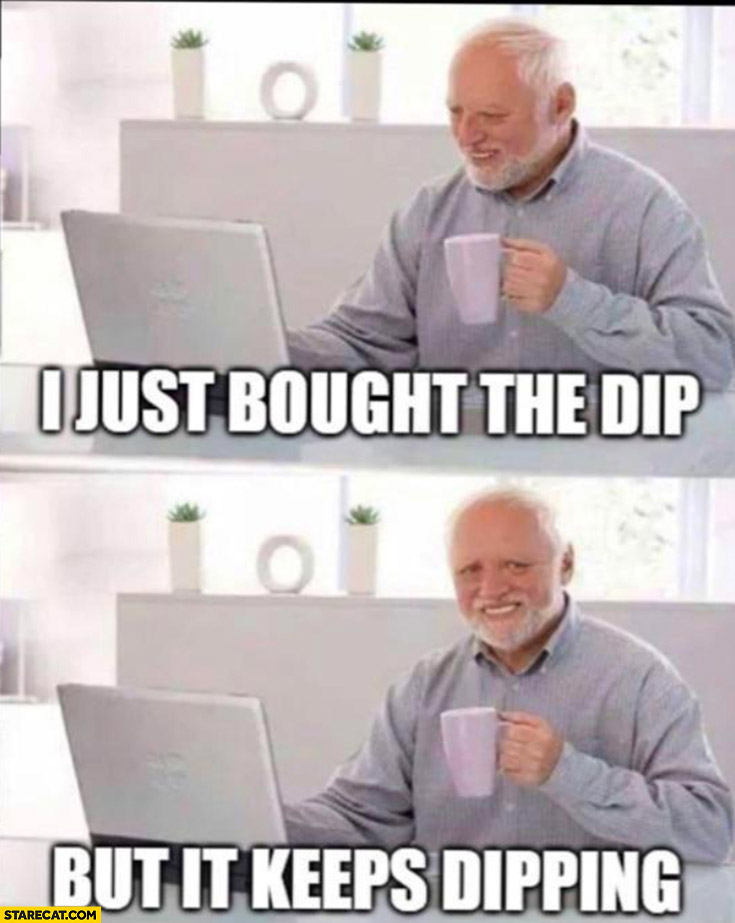

My thoughts on today.

__________________ Quote: | Owner of Vansterdam's 420th thanks. OH YEAUHHH. | Quote:

Originally Posted by 89blkcivic  Did I tell you guys black is my favourite colour? My Ridgeline is black. My Honda Fit is black. Wish my dick was black........ LOL. | |

|  |  01-25-2022, 09:00 AM

01-25-2022, 09:00 AM

|

#11419 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,913

Thanked 5,857 Times in 2,828 Posts

Failed 315 Times in 156 Posts

| Quote:

Originally Posted by PeanutButter  That's actually smart of you. Don't trust people on the internet.

In regards to TSLA, their potential is huge. Just look out for their earnings coming out this week. They are going to blow out for the quarter.

I'm hoping TSLA will split soon, that way it's easier to buy. | Ironically, when you said that bolded part, you earned my trust  ... and you sound like you think through things logically so I threw some of my play portion $$ into it. Now let's get the popcorn ready and wait for the earning report.

|

|  |  01-25-2022, 02:55 PM

01-25-2022, 02:55 PM

|

#11420 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

| Quote:

Originally Posted by whitev70r  Ironically, when you said that bolded part, you earned my trust  ... and you sound like you think through things logically so I threw some of my play portion $$ into it. Now let's get the popcorn ready and wait for the earning report. | Oh man, I think I just scammed you. Now I can unload my TSLA shares onto you!! haha jk. I'm NEVER going to sell my shares.

Earnings are going to BLOW OUT, for sure. The problem is, I don't think the stock price will react positively. The financials should be priced in because TSLA already announced their positive production numbers (which beat all expectations).

TSLA is a long term hold. It's highly volatile also. So just be aware the position will swing 10-30%. That's normal. I just don't want to see your position down 30% and then you think of selling. Please don't sell any of your TSLA shares, it's going to be the best investment you'll ever make.

If you look at the top 10 businesses by revenue in the world, the majority of them are either car companies or energy companies. The thing about TSLA, it's both. Once TSLA ramps its solar and powerwall business, they will become the largest company in the world. The crazy part, no one is even talking about TSLA's energy business. That's why I feel like TSLA's runway is so long.

The macro-environment right now is really bad, so the market is probably going to dip in the short term, but if you have a long-term mindset and you can see TSLA's vision, it's inevitable TSLA will be the biggest company in the world.

|

|  |  01-26-2022, 02:57 AM

01-26-2022, 02:57 AM

|

#11421 | | OMGWTFBBQ is a common word I say everyday

Join Date: Dec 2002 Location: YVR/TPE

Posts: 5,142

Thanked 3,220 Times in 1,418 Posts

Failed 676 Times in 219 Posts

|

The thing with TSLA, if you believe that the future of automobile is EV, is to buy them and forget about them.

Short term corrections, as much as the drop in 2020 due to covid, which TSLA dropped by a whopping 58%, I saw it and was like... meh... and I kept buying with money I've got and just ignore temporary shocks completely. The reason is that it already passed the stage where it's burning a huge amount of money to get their feet straight like Rivian or other EV startups. (which might go under if the whole plan doesn't work out) With Giga Austin and Berlin coming online, it just going to continue to dominate the EV scene. They are no longer in the stage of making it work... they are perfecting their craft.

VW already admitted that they are having a hard time transitioning to EVs and do not have the necessary cashflow to convert all their plants to EV. Toyota isn't doing shit about EV, and Detroit big 3?

I've learned a lot of the basic of EV growing up playing Tamiya JCT by building my own motor, but I know jackshit about how to build a car engine. And when you look at it from the other way around, legacy carmakers know nothing about building EVs. Yes, the basic concept is easy. Anyone with basic electronic knowledge can have a motor working. But the problem is perfecting it, and competing with the market leader (TSLA) that's already so far ahead and have all the best engineers in the field working on it for the past decade.

And that's just the auto portion of the company.

And I think the same thing can be said for companies who have the market dominance and know-how to continue dominating. I bought TSMC and NVDA for this same reason as TSLA. I just leave them there and don't look at ups and downs anymore. The only thing I sold was NVDA when it hit 300, which I needed some fund for other investments and I thought they have reached a short-midterm high.

But the lesson is simple. Don't try to time the market. Not even giants like Berkshire Hathaway can do it. Just invest in good companies and ride along. And never gamble. I only invest with money I don't need and rarely on margin. So I never get margin call and never worry too much as my life wouldn't change in any way regardless they go up or down.

__________________

Nothing for now

|

|  |  01-26-2022, 07:58 AM

01-26-2022, 07:58 AM

|

#11422 | | Where's my RS Christmas Lobster?!

Join Date: Sep 2002 Location: PoCo

Posts: 815

Thanked 1,262 Times in 205 Posts

Failed 3 Times in 3 Posts

| Quote:

Originally Posted by Hehe  ...Toyota isn't doing shit about EV... | Didn't Toyota announce a $70 Billion dollar investment into electrification a month ago? $70 billion sounds like some serious shit, although they should have done it a long time ago.

|

|  |  01-26-2022, 08:03 AM

01-26-2022, 08:03 AM

|

#11423 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 39,479

Thanked 16,089 Times in 6,561 Posts

Failed 2,165 Times in 747 Posts

|

i think obviously the problem with TSLA is overvaluation. They aren't an apple or google with vaults full of cash, their valuation is based on speculation and potential.

They also have this meme/fan boy type following which seems to artificially inflate their price even moreso. Unless they can continue to be the industry innovator once a Honda/Toyota can come up with a vehicle that competes with the model 3 at a friendlier price i think that will be a huge hit to the attractiveness of Tesla

__________________

Dank memes cant melt steel beams

|

|  |  01-26-2022, 09:31 AM

01-26-2022, 09:31 AM

|

#11424 | | I contribute to threads in the offtopic forum

Join Date: Apr 2001 Location: VAN/RMD/BBY

Posts: 2,596

Thanked 1,022 Times in 450 Posts

Failed 54 Times in 30 Posts

| Quote:

Originally Posted by immorality  Didn't Toyota announce a $70 Billion dollar investment into electrification a month ago? $70 billion sounds like some serious shit, although they should have done it a long time ago. | Source: https://www.bnnbloomberg.ca/titans-o...musk-1.1703222

Half of that $70 Billion will go towards fully electric vehicles. So they're not completely out of the ICE game just yet and see a market for hybrids still. Or who knows, maybe hydrogen will finally catch on.

|

|  |  01-26-2022, 11:50 AM

01-26-2022, 11:50 AM

|

#11425 | | OMGWTFBBQ is a common word I say everyday

Join Date: Dec 2002 Location: YVR/TPE

Posts: 5,142

Thanked 3,220 Times in 1,418 Posts

Failed 676 Times in 219 Posts

| Quote:

Originally Posted by immorality  Didn't Toyota announce a $70 Billion dollar investment into electrification a month ago? $70 billion sounds like some serious shit, although they should have done it a long time ago. | Look at what they do, don't listen to what they say.

Right now, EV production is already constrained by the amount of cell made available on the market. Tesla, VW, Ford and GM all locked themselves into long term battery cell contracts with battery producers, who basically pre-sold their future increase in production. And from there, you can basically derive the potential production and market share in the next 5yr horizon.

By not seriously revising their expenses toward EV related expenditures, Toyota is risking itself to be left behind. They'd either have to pay a huge premium for whatever remaining on the market, or make do to subpar products.

Tesla is valued as it is today because it's the only carmaker that's truly "all-in" on EV. All their capex are spent on more batteries, more efficient productions and more volume. It thinks from an EV perspective and nothing else. They are trying to make people to adapt to the new normal, just like how we shifted from old dumb phone to smartphones, and not trying to come up with half-way solutions just so that people can accommodate their ICE "habits".

Switching from ICE to EV is not something of a flip of a switch. If you look at the recent interview Herbert Diess (VW group CEO) did with t, there are a lot of things involved to go from ICE production to EV. They all take time and money. If Toyota is not doing it today (as in actually signing contracts with other important partners)... it doesn't matter what it says. It can say it plans to spend 1T for the next decade to go EV, but until deals are done, they've got nothing other than some talk to ease off investors' worries that they are being too stubborn.

__________________

Nothing for now

|

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 09:38 AM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!