The Business and Financial Forum CIBC.RBC-RoyalBank.TD-CanadaTrust.BMO.ScotiaBank.

Consolidating debt? Good business tips? Buying stock? How's our economy doing? Discuss and share advice and tools on everyday banking, investing, wealth management and insurance.. |

| |  01-27-2023, 10:40 AM

01-27-2023, 10:40 AM

|

#11551 | | OMGWTFBBQ is a common word I say everyday

Join Date: Dec 2002 Location: YVR/TPE

Posts: 5,142

Thanked 3,220 Times in 1,418 Posts

Failed 676 Times in 219 Posts

|

Hope you have closed your short position in time as tsla has hit 70% gain YTD. And we are only 3 weeks into the year.

__________________

Nothing for now

|

|  |  01-27-2023, 04:49 PM

01-27-2023, 04:49 PM

|

#11552 | | OMGWTFBBQ is a common word I say everyday

Join Date: Jan 2005 Location: Vancouver

Posts: 5,185

Thanked 1,379 Times in 578 Posts

Failed 96 Times in 53 Posts

| Quote:

Originally Posted by Hehe  Hope you have closed your short position in time as tsla has hit 70% gain YTD. And we are only 3 weeks into the year. | Great ER. Lots great numbers to digest and particularly like how they already got a line a credit from Citi to prepare for the worse

Regret not buying back my tsla near $100 ish. Now I gotta rebuy higher  |

|  |  01-31-2023, 11:48 AM

01-31-2023, 11:48 AM

|

#11553 | | Performance Moderator

Join Date: Jun 2001 Location: Richmond

Posts: 18,976

Thanked 20,735 Times in 7,063 Posts

Failed 322 Times in 213 Posts

|

Clenched a bit and felt like I might be catching a falling dagger at the time, but I begrudgingly bought into Tesla at $112... feeling like a pretty prudent move thus far (easy to say in hindsight!)

|

|  |  03-06-2023, 11:30 AM

03-06-2023, 11:30 AM

|

#11554 | | My homepage has been set to RS

Join Date: Jan 2012 Location: vancouver

Posts: 2,448

Thanked 1,762 Times in 546 Posts

Failed 1,107 Times in 281 Posts

|

What do you guys think about India market since most companies are pulling out of China?

|

|  |  05-04-2023, 11:56 AM

05-04-2023, 11:56 AM

|

#11555 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,911

Thanked 5,856 Times in 2,828 Posts

Failed 315 Times in 156 Posts

|

Holy Cow ... Shopify !!!

|

|  |  08-23-2023, 11:54 AM

08-23-2023, 11:54 AM

|

#11556 | | in the butt

Join Date: Aug 2016

Posts: 3,353

Thanked 4,498 Times in 1,600 Posts

Failed 211 Times in 115 Posts

|

Revscene needs to update it's code to allow picture uploads https://www.reddit.com/media?url=htt...762fc580c77e4a

__________________ Quote:

Originally Posted by Mr.Money

i hate people who sound like they smoke meth then pretend like they matter.

Originally Posted by ilovebacon

Does anyone have a pair of 25 pounds one-inch hole for sale at a reasonable price?

Originally Posted by Gerbs

For $6xx for 2br 2ba, they can shit in the elevator and key my cars

| |

|  |  08-23-2023, 01:17 PM

08-23-2023, 01:17 PM

|

#11557 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,260

Thanked 2,948 Times in 1,163 Posts

Failed 258 Times in 75 Posts

|

Wow 1.16T Mkt cap

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

|

|  |  08-23-2023, 02:19 PM

08-23-2023, 02:19 PM

|

#11558 | | Say! Say! Say!

Join Date: Aug 2005 Location: Japan

Posts: 15,549

Thanked 3,393 Times in 1,497 Posts

Failed 246 Times in 65 Posts

|

88% increase in revenue, absolutely nuts.

__________________ Quote: | Owner of Vansterdam's 420th thanks. OH YEAUHHH. | Quote:

Originally Posted by 89blkcivic  Did I tell you guys black is my favourite colour? My Ridgeline is black. My Honda Fit is black. Wish my dick was black........ LOL. | |

|  |  09-01-2023, 09:43 AM

09-01-2023, 09:43 AM

|

#11559 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,911

Thanked 5,856 Times in 2,828 Posts

Failed 315 Times in 156 Posts

|

Traditionally, when economy is like this, higher interest rates, higher possibility of foreclosure ... what happens to bank stocks? They are all pretty low now. What does recovery curve look like in terms of time or economic conditions?

|

|  |  09-01-2023, 10:07 AM

09-01-2023, 10:07 AM

|

#11560 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,260

Thanked 2,948 Times in 1,163 Posts

Failed 258 Times in 75 Posts

|

I think margin stays relatively the same since they borrow at the overnight rate, I imagine demand lowers. Usually recession favours the safer stocks though. Big 5 bank can't ever go under.

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

|

|  |  09-01-2023, 07:14 PM

09-01-2023, 07:14 PM

|

#11561 | | Wunder? Wonder?? Wander???

Join Date: Feb 2011 Location: Vancouver

Posts: 215

Thanked 320 Times in 96 Posts

Failed 13 Times in 4 Posts

| Quote:

Originally Posted by whitev70r  Traditionally, when economy is like this, higher interest rates, higher possibility of foreclosure ... what happens to bank stocks? They are all pretty low now. What does recovery curve look like in terms of time or economic conditions? | Stock market is like a sea and bank stocks are like ships. When the sea lowers, it drags the ships lower.

High inflation leads to high interest rate leads to unemployment leads to reduced economic activity and poor credit lending, leads to a systemic event leads to recession/depression.

Bank stocks along with most other equities will be dragged down--we're talking about a 30%+ drawdown.

Personally my own forecast is that bank stocks go down to a 7+% yield (BMO, TD, RY) during the crisis. and it would take another 4+ years from bottom to tick back up to relatively normal levels.

|

|  |  09-02-2023, 12:20 AM

09-02-2023, 12:20 AM

|

#11562 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

|

^What do you mean the bank stocks go down to a 7+% yield? Which big five bank ever had a 7% yield?

During mild inflationary times, banks do well because they get to charge higher rates. When the rates rise too quickly though, this is problematic because people stop spending, which in turn affects banks because they are not able to lend money out in the same volume, which equals less profit for the banks, and causes recessionary times.

I also wouldn't say bank stocks are "low right now". They're only about 15% off from their all-time highs.

When interest rates rise, this puts downward pressure on equity markets. Historically, the S&P 500 returns 10% per year, the closer the risk free rate gets to 10%, more people will just buy fixed income products. We're seeing 5-6% GICs right now which is risk free. Less people are going to invest in the equity market if their expectation is a 10% average return, when they can get 6% risk free.

With any investment, you have to look at the long-term. Your question is inherently short-term focused, which is asking to time the market, which is impossible to predict.

Like every other period, we're in uncharted territory, no one knows what the market is going to do.

|

|  |  09-02-2023, 08:34 AM

09-02-2023, 08:34 AM

|

#11563 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 9,911

Thanked 5,856 Times in 2,828 Posts

Failed 315 Times in 156 Posts

|

^ maybe he means +7% yield pa, even then it depends your start and end yr period. From Covid to the time before banks stocks crashed ~ 2yrs, i was getting double digit returns, that plus dividends was impressive. Yes, it was corrective period when economy got going again. But this is the best time (in a while) to 'buy' bank stocks if you're in it for the long haul.

|

|  |  09-02-2023, 10:52 AM

09-02-2023, 10:52 AM

|

#11564 | | Wunder? Wonder?? Wander???

Join Date: Feb 2011 Location: Vancouver

Posts: 215

Thanked 320 Times in 96 Posts

Failed 13 Times in 4 Posts

|

Scotiabank generally gives around 1%+ dividend yield more than the other banks. During COVID, that's how exactly it played out. BNS gave a 7% dividend and I took the opportunity along with BMO at around 6% yield which historically, they both have been on the higher end (low stock price).

You've hit part of the nail on the head PeanutButter, yes completely agree with you that once interest rates tick up, there's more attractive investments out there such as a risk free 5-6% GIC which leads to less money in the stock market. I also said the same thing and fully agree with you.

In regards to your comments on no one is able to predict what will happen/market is going to do-- I'm going to say that's true to some certain extent. I was a staunch believer of the "you can't time the market and just invest in the S&P 500 dollar-cost averaging camp" but I've actually changed my tune.

You can actually to a certain degree predict what will happen to the stock market on a short-medium term horizon. How? It's probabilities, indicators, and looking at history. Warren Buffett times the market, although he tells the masses to not do so and the reason is because most people don't know what they're doing or have the stomach for it. He's building his cash powder right now in anticipation to be a bailout god.

Every time the interest rate rises, there has been a slowdown in the economy and subsequently the stock market. Many leading indicators at this moment are showing a slowing economy. I can talk about this for a long time but I'll give you the shortest summary and this is what all the economists, media, government, and corporations will not tell the public.

In order to get inflation down, unemployment needs to go up.

Now read that again.

On the supply side, it's pretty much ok. But there is so much demand for products right now that remains inflationary. Not to mention that the thought of inflation remains on peoples' minds. The moment they lower the rates, people will be scrambling to buy houses, cars, and products.

The ONLY way to kill off inflation is to kill the demand side of the equation. Who is on the demand side of the equation? It's people. High interest rates will result in unemployment because the returns of a business borrowing money to generate better returns in the future are not worth it.

So they perform layoffs (which we've seen), now the land speculation ends now (see developers no longer building anymore, they're just holding their land due to high borrowing costs).

People will lose their jobs. and they will sell their cars, EQUITIES, homes, to survive. The dying consumer leads to lower business profits and the high interest rates will also crush businesses which will lead to bankruptcies.

The result is a systemic event. We've seen SVB, and First Republic Bank fail. That was the first dominoes. Do you see loss provisions in ALL Canadian banks tick up much higher? They're aware that there's a lot of delinquent mortgages on their books. And we haven't seen all the mortgages renew yet.

So, yes you can time the market. There will be a HARD LANDING. People are begging for rate cuts by the FED. But when they do, it's because something is systematically fucked. 2024 will be be very painful.

You can look back on my post history and I've been consistently saying the same thing and what I've said is happening at the moment.

|

|  |  09-03-2023, 10:54 AM

09-03-2023, 10:54 AM

|

#11565 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,260

Thanked 2,948 Times in 1,163 Posts

Failed 258 Times in 75 Posts

| Quote:

Originally Posted by PeanutButter  ^What do you mean the bank stocks go down to a 7+% yield? Which big five bank ever had a 7% yield?

During mild inflationary times, banks do well because they get to charge higher rates. When the rates rise too quickly though, this is problematic because people stop spending, which in turn affects banks because they are not able to lend money out in the same volume, which equals less profit for the banks, and causes recessionary times.

I also wouldn't say bank stocks are "low right now". They're only about 15% off from their all-time highs.

When interest rates rise, this puts downward pressure on equity markets. Historically, the S&P 500 returns 10% per year, the closer the risk free rate gets to 10%, more people will just buy fixed income products. We're seeing 5-6% GICs right now which is risk free. Less people are going to invest in the equity market if their expectation is a 10% average return, when they can get 6% risk free.

With any investment, you have to look at the long-term. Your question is inherently short-term focused, which is asking to time the market, which is impossible to predict.

Like every other period, we're in uncharted territory, no one knows what the market is going to do. | During 2020 Covid they were at 6-9% Yield at bottom prices. Same with most of oil and gas, REITS, and a few other dividend stock. But you'd have to double check if they lowered dividends in 2021.

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

|

|  |  09-10-2023, 10:28 AM

09-10-2023, 10:28 AM

|

#11566 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

|

@lamboda, sounds like you have a pretty good insight, but if I could push back on some of your ideas...

I don't think Buffet times the market at all, he's said many times he doesn't know how to time the market and if he did, he would be a lot richer (ironic, I know). His last blunder was when he literally sold his airline stocks at the lowest point possible during covid because his outlook on that industry changed. Buffet just buys positions he feels will outperform in the long term as long as their evaluation is fair. He doesn't time the market, he just buys businesses at what he thinks is a fair evaluation. Look at his initial Apple purchase, he was buying at all time highs, CNBC "Experts" were questioning his buy at that time because of their evaluation, if he was timing the market, he wouldn't have bought, but he bought because his evaluation of apple at that time was still favourable and it wasn't solely dependent on the stock price.

It's super hard to time the market and the people I know who use TA and Macro may have some insight in the short term, but in the long run I don't see their portfolio outperforming the S&P. Buffet literally made this bet already ( https://www.investopedia.com/article...-brka-brkb.asp)

As far as I know, Buffet doesn't really give bailouts. During the financial crisis of 2008 he didn't help out anyone and during the latest regional bank crisis he didn't help anyone. I was surprised he didn't buy any of the banks in this last fiasco because he was on record saying during 2008 he should have bought fannie mae or freddie mac as they were pennies on the dollar and he should pulled the trigger but even he got worried, so I was sure he was going to pick up some cheap banks this time around, but he didn't.

Also, the latest regional banking crisis was not a common event. It's not like these banks were being so egregious like they were in 2008, these banks simply bought bonds that on paper went negative because we had the biggest rise in interest rates in history and they didn't have the liquidity to secure peoples deposits because there was a run on the bank. To me, it was more of a black swan event.

It also depends on what your definition of a hard landing is. Hard landings to me are just economic slow downs/recessions, which is a normal part of the market cycle, so it should be expected and encouraged for a healthy market. The market can't go up or down in straight line. I'm still buying on a consistent basis and i'm expecting my portfolio to fund my retirement in 15 years. I have friends who are sitting on cash right now and I think they're going to miss the next run up.

|

|  |  09-11-2023, 12:38 PM

09-11-2023, 12:38 PM

|

#11567 | | Wunder? Wonder?? Wander???

Join Date: Feb 2011 Location: Vancouver

Posts: 215

Thanked 320 Times in 96 Posts

Failed 13 Times in 4 Posts

|

@PeanutButter

- You're right, I'd like to retract that statement I made about Warren Buffett timing the market. and I agree with you that he buys at a discount/great business at a higher price (the latter is because his capital is so large, that he's restricted from buying small, better businesses).

One thing I'd like to expand and add is that when people talk about Buffett, they always cite him saying buy an index fund for example or to copy what his moves are, which are namely in large businesses.

There is hidden gems that he drops which the majority of people don't know about-- and that's buying small, unloved businesses which are priced below their value.

- Regarding bailouts on Buffett, he "bails them out" by buying preferred shares which gives a cash injection to the company. Look at Goldman and Buffett in 08. This current bank crisis isn't over in my opinion and there hasn't really been "blood on the streets yet" so I'm sure there's opportunities for him in the near future.

- I agree, I don't like TA and don't care for it. It will never be as successful as long term value investing. I understand Buffett made the bet and won. But what I'm saying as "timing the market" is different than using TA.

There is a cycle people know it as the business cycle. But it's more of a real estate cycle. Approximately every 18 years there is a recession. Barring no extraordinary situations. And it usually happens when inflation starts running rampant. The only way for inflation to be tamed is to kill demand or increase supply. More often than not demand is killed by raising interest rates which lead to economic recessions and significant drawdowns in the stock market over the subsequent years.

Look at this chart regarding inflation. Correlate the peak inflations to the S&P performance for the next few years. It often falls.

Most of the time when interest rate goes up, economic activity stalls, which results in lower profits for companies and bankruptcies (for both company and consumers). So maybe it cannot be timed the market to a T but the probabilities and indicators are telling us that it will likely happen.

- The latest regional banking crisis is a common event in systemic risk events. When interest rate rises there will be systemic event as stated above, lower consumption, lower profits, higher interest rate payments if money was borrowed, etc. Thing is, banks have been lobbying for less restrictions on themselves, see Dodd-Frank act being partially repealed. Bankers are greedy and history repeats itself, and do not think for a second banks are any less egregious than they were.

- Hard landings is my way of saying there will be a large negative economic impact on many people, businesses, and ultimately the stock market. I continue to believe there's a 30%+ drawdown (we saw it happen already and we rallied back up sure, but will likely happen again).

- I agree with you in that there is potential to miss the run up, like this last dip bought. I can humbly say I did miss it and wasn't expecting it but learned that lesson. However, I also understand that I missed it because I have my thesis and rather preserve my capital for the actual drop which has again in my opinion yet to manifest.

|

|  |  09-11-2023, 07:32 PM

09-11-2023, 07:32 PM

|

#11568 | | Old School RS

Join Date: May 2004 Location: Port Moody

Posts: 4,641

Thanked 4,157 Times in 1,262 Posts

Failed 130 Times in 80 Posts

| Quote:

Originally Posted by Lamboda  You can look back on my post history and I've been consistently saying the same thing and what I've said is happening at the moment. | Even a broken clock is wrong twice a day.

Behavioral finance is a really interesting area of study and there are a bunch of well-documented totally common responses that we have as humans that make it hard to make good decisions around investing.

As humans, we generally have no problem visualizing the risk around making an investment and having it go down in value. However, we generally do not accurately assess the cost of NOT making the investment - the opportunity cost.

My dad has been citing numbers, facts, and figures for a decade about how Vancouver real estate is detached from fundamentals, is in a bubble, will end up having a huge drawdown at some point, and so on. At some point, he'll be right, but the number of years that he's been wrong will mean that overall he'll be worse off.

The same is absolutely true in the stock market. It is easy to sit here and pick things apart in the market and point out risks, and talk about sitting out, but our clients who are in the 100% equity portfolio are up approximately 17% for 2023 so far. That's the cost of sitting on the sideline and 'waiting for the crash' that may or may not happen.

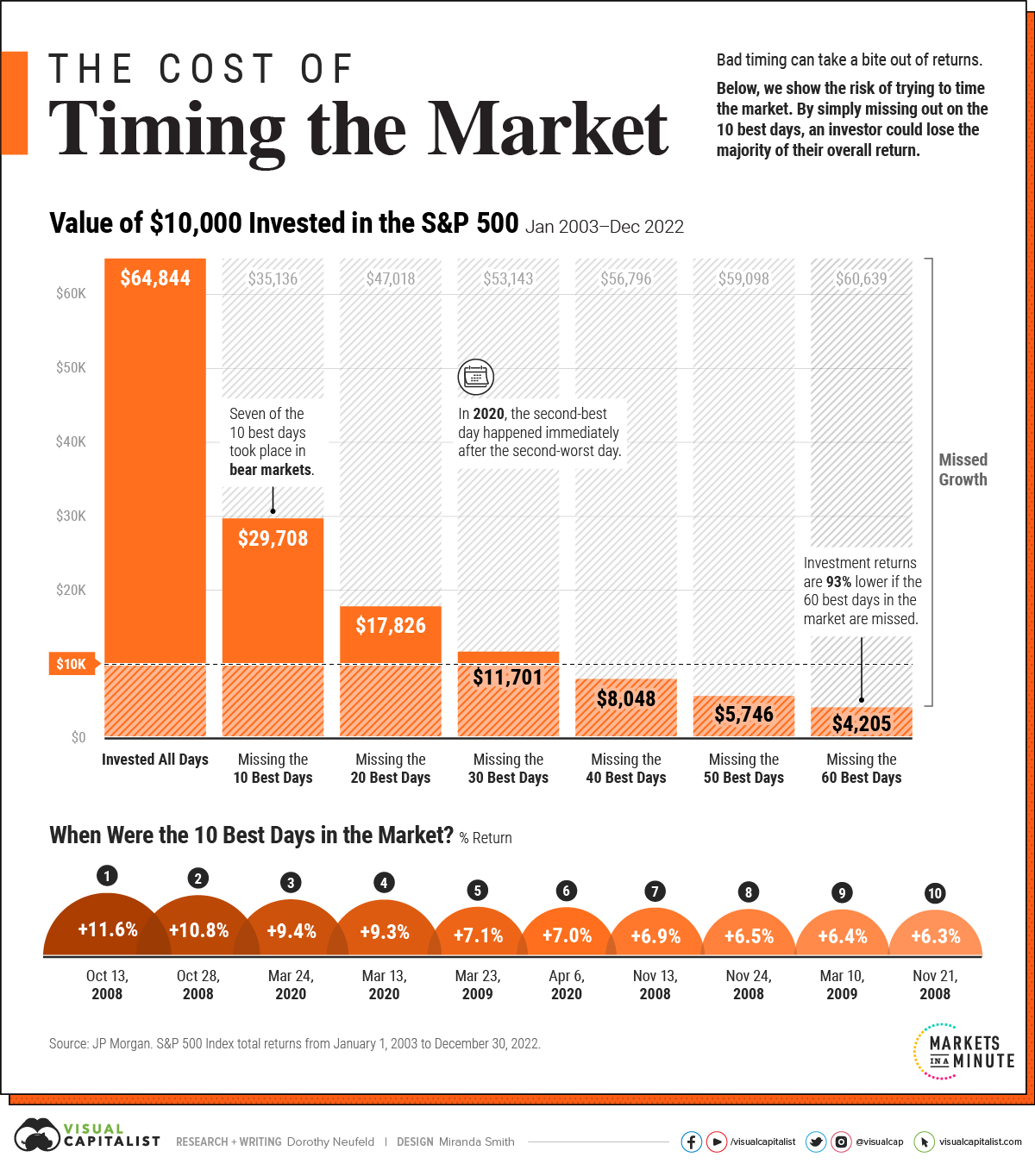

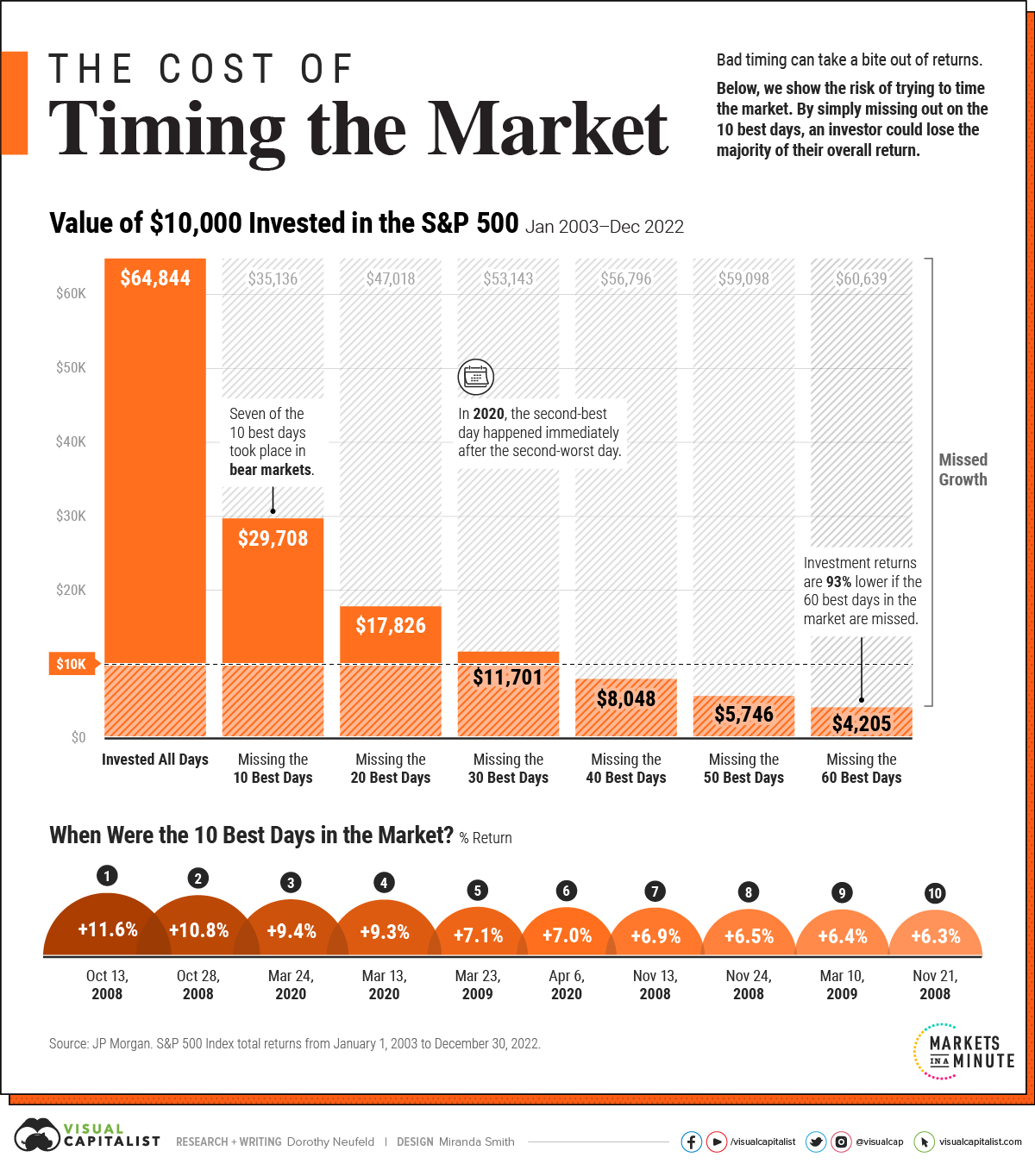

I think this is a great chart. The really important takeaway is a) if you just missed a few days, you are a lot worse off, and b) more importantly 7/10 best return days in the last 20 years were in bear markets (periods of time that people were afraid, critical, and generally "sitting out")

-Mark

__________________

I'm old now - boring street cars and sweet race cars. |

|  |  09-11-2023, 10:56 PM

09-11-2023, 10:56 PM

|

#11569 | | Wunder? Wonder?? Wander???

Join Date: Feb 2011 Location: Vancouver

Posts: 215

Thanked 320 Times in 96 Posts

Failed 13 Times in 4 Posts

| Quote:

Originally Posted by lowside67  Even a broken clock is wrong twice a day | Except this is the first time I've ever said this during this hike cycle. I'm not a permabear calling a recession or crash every year. And I'm humble enough to admit if I'm wrong that it doesn't occur in the next (or few years). I also understand the opportunity cost of money but to me, I rather preserve my capital at such a precarious time.

My thesis and opinion is probably not be suited for most people. I respect DCAing and I always tell my friends that who are just looking for some simple advice. Ignore the market, buy VOO or QQQ DCA, forget about it until you retire.

|

|  |  09-12-2023, 10:15 AM

09-12-2023, 10:15 AM

|

#11570 | | I contribute to threads in the offtopic forum

Join Date: Jun 2013 Location: Burnaby

Posts: 2,623

Thanked 3,075 Times in 836 Posts

Failed 412 Times in 112 Posts

|

The most fascinating thing about investing to me is that it's really easy to tell who the winners and losers are, you just have to look at their portfolio. It's one of the very few areas that is black and white.

Your thesis can be sound and make sense, but at the end of the day, we'll look at your portfolio in 10 or 20 years and we can see what's going on. That's the coolest part about investing.

Most people do not have the knowledge or desire to become wealthy, hopefully like you said, @Lamboda, people will just buy an index fund on a regular basis, but most don't. It's really sad because I know lots of friends that won't have much to their name when we're 60. If my thesis is correct my family will be living the good life while my friends will be still grinding it out.

I subscribed to Buffet and Lynch's paradigm that you should only hold a few businesses and know them really well. If they're good businesses you should buy your stake in it and hold, if the thesis changes, get out, but if it's still a good business, then you have to buy and hold.

I agree, if you want to get exceptional returns you'll have to go outside of index funds, but the risk of investing in individual companies increases exponentially, which is why most people don't make money trading stocks. That being said, my dumbass thinks I can beat the market and in 10-15 years it's going to be really easy to tell if I was right or wrong.

The only reason I can take this risk is that i'm relatively young and my wife gets a government pension at work, which means I get to swing for the fences. I also lucked out during the marijuana craze and got out with some healthy profits, so I secured housing earlier than a lot of my peers in my group.

|

|  |  09-14-2023, 10:00 PM

09-14-2023, 10:00 PM

|

#11571 | | RS.net, where our google ads make absolutely no sense!

Join Date: Jul 2004 Location: vancouver

Posts: 930

Thanked 205 Times in 48 Posts

Failed 28 Times in 9 Posts

|

So I'm heavily invested in equities/funds and am concerned about the recession and market slow down. With @lambdo talking about a possible crash (+30%), would it be wise to get out of equities/funds and temporarily move to a secured investment (GIC ~5%) for 1-3 years. I understand the opportunity cost that I might miss out on potential gains during the 1-3 years in the market if it goes up, but IF there is a crash, at least I'm not losing ~10-30% of my portfolio.

|

|  |  09-15-2023, 07:52 AM

09-15-2023, 07:52 AM

|

#11572 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 39,479

Thanked 16,089 Times in 6,561 Posts

Failed 2,165 Times in 747 Posts

|

If anyone had a concrete answer to that I’m sure we’d all be much wealthier lol

__________________

Dank memes cant melt steel beams

|

|  |  09-15-2023, 04:02 PM

09-15-2023, 04:02 PM

|

#11573 | | Wunder? Wonder?? Wander???

Join Date: Feb 2011 Location: Vancouver

Posts: 215

Thanked 320 Times in 96 Posts

Failed 13 Times in 4 Posts

| Quote:

Originally Posted by xxxrsxxx  So I'm heavily invested in equities/funds and am concerned about the recession and market slow down. With @lambdo talking about a possible crash (+30%), would it be wise to get out of equities/funds and temporarily move to a secured investment (GIC ~5%) for 1-3 years. I understand the opportunity cost that I might miss out on potential gains during the 1-3 years in the market if it goes up, but IF there is a crash, at least I'm not losing ~10-30% of my portfolio. | My opinions are my theories, whether it's right or wrong. I'm voicing them for awareness and to provide an alternative opinion rather than the masses following the media and or unaware of the situation.

No one can advise you on the decisions you make with your investments other than qualified/certified professional. I suggest you take my theories with a grain of salt and due your own research.

I am convicted in my own intuition, research, and history because I did the legwork. I have a plan in place already for the opportunity.

Everyone has been saying GIC is a good position right now. And you can always take it out albeit you lose out on the interest if it's fixed term.

There's also other bond ETFS available such as SGOV which is a 3-month bond yielding ~3.6% annually paying dividends monthly USD. Again, do your research.

|

|  |  02-15-2024, 10:53 PM

02-15-2024, 10:53 PM

|

#11574 | | in the butt

Join Date: Aug 2016

Posts: 3,353

Thanked 4,498 Times in 1,600 Posts

Failed 211 Times in 115 Posts

|

How hard is SMCI going to crash?

The 5 year chart is like looking at a meme

__________________ Quote:

Originally Posted by Mr.Money

i hate people who sound like they smoke meth then pretend like they matter.

Originally Posted by ilovebacon

Does anyone have a pair of 25 pounds one-inch hole for sale at a reasonable price?

Originally Posted by Gerbs

For $6xx for 2br 2ba, they can shit in the elevator and key my cars

| |

|  |  02-16-2024, 08:29 AM

02-16-2024, 08:29 AM

|

#11575 | | Old School RS

Join Date: May 2004 Location: Port Moody

Posts: 4,641

Thanked 4,157 Times in 1,262 Posts

Failed 130 Times in 80 Posts

| Quote:

Originally Posted by Lamboda  Everyone has been saying GIC is a good position right now. And you can always take it out albeit you lose out on the interest if it's fixed term. | This is generally not true for a normal fixed-term GIC. They have 0 liquidity at any time until the end of the term, unless you/your institution can find somebody to buy a mid-term GIC. This is generally done (if at all possible) at a significant discount - aka you stand to lose more than just the interest. On the other hand, a redeemable GIC would act like you are describing (typically they have a shorter period where you would lose the interest only, and if you own it for awhile, you can redeem with no penalty). Quote: |

There's also other bond ETFS available such as SGOV which is a 3-month bond yielding ~3.6% annually paying dividends monthly USD. Again, do your research.

| I am not really sure what the rationale is for owning a product like that versus any number of Canadian options (including redeemable GICs) that would pay a higher rate, and in Canadian dollars.

The last posts you quoted of mine were in September. Since that time, the equity portfolio is up nearly another 10% and in the same time period, a GIC would have paid you about 2-2.5% (5 months). The problem with the move to cash is it works brilliantly if you could perfectly time when to get in and out, but none of us can. And if you believe in the long run that markets go up (a fundamental requirement for basically all economies to function), it means on average you will be worse off trying to time this strategy.

Nobody ever went broke on GICs, but for average Canadians, trying to time the market instead of being invested over multiple decades consistently will absolutely, unequivocally, result in them being significantly disadvantaged at retirement.

-Mark

__________________

I'm old now - boring street cars and sweet race cars. |

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 10:44 PM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!