| Vancouver Off-Topic / Current Events The off-topic forum for Vancouver, funnies, non-auto centered discussions, WORK SAFE. While the rules are more relaxed here, there are still rules. Please refer to sticky thread in this forum. |

| |  10-30-2024, 12:15 PM

10-30-2024, 12:15 PM

|

#33501 | | RS Veteran

Join Date: Dec 2001 Location: GTA

Posts: 30,393

Thanked 12,199 Times in 4,992 Posts

Failed 468 Times in 304 Posts

|

Sounds like a great idea. Go for it. YOLO. high value and all.

__________________ Quote:

Originally Posted by BIC_BAWS  I literally do not plan on buying another vehicle in my lifetime, assuming it doesn't get written off. | Quote:

Originally Posted by Badhobz  I think she’s one of those weirdos who gets off on feeding fat fucks. Pretty sure she feeds me and then goes home to cook her own baooo yuuu with supreme sauce | |

|  |  10-30-2024, 12:41 PM

10-30-2024, 12:41 PM

|

#33502 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2014 Location: Van

Posts: 5,242

Thanked 2,185 Times in 1,171 Posts

Failed 221 Times in 133 Posts

|

Heloc money back out and all in on nvd. Rent it out and live at home ??? Profit. And you don't lose money on buy sell bs fees and tax

|

|  |  10-30-2024, 12:56 PM

10-30-2024, 12:56 PM

|

#33503 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 38,545

Thanked 15,449 Times in 6,244 Posts

Failed 2,115 Times in 722 Posts

| Quote:

Originally Posted by Gerbs  Renewal is up in < 60 days, total housing costs will be close to $3K/month for a 20 year old 1BR in Van. If I rent my place, I can net $6K/year pre-tax. Equity can net around $20-24K/year average index gains.

A few of my friends are going full-equity and renting cheaper places. We all plan to upgrade to duplex/TH ($5-7K/mo) in the next 3-5 years with future partner. So there's no incentive to go from 1BR to 2/3BR.

I'm thinking about doing the same so I can be more mobile, try living in new areas and potentially new cities.

Anyone else liquidate their only PR for a short period of time? Everyone is saying no but math makes sense to me. |

Every single person I know who’s done this has no owned primary residence any longer lol.. like 4/4 of them thought the same thing and cost of living and cost of housing outpaced their plan and now they are all renting

It’s a risky game to play imo

__________________

Dank memes cant melt steel beams

|

|  |  10-30-2024, 01:00 PM

10-30-2024, 01:00 PM

|

#33504 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2001

Posts: 5,078

Thanked 2,602 Times in 1,177 Posts

Failed 81 Times in 54 Posts

|

Honda is actually making sense here:

Most people who play this game get burned, but you do you. Your friends who are all enabled by their high wealth families can probably take more risks than you can, which is why it seems enticing.

As it is with relationships with other human beings, it's not all about numbers in life.

|

|  |  10-30-2024, 01:23 PM

10-30-2024, 01:23 PM

|

#33505 | | linguistic ninja

Join Date: Aug 2001 Location: Vancouver, BC

Posts: 16,467

Thanked 4,412 Times in 1,580 Posts

Failed 145 Times in 83 Posts

|

500/mo net is basically nothing with all the trouble you're probably likely going to break even if not lose. 20-24k in index gains based on what initial investment? After a 40% historic 1 year return in the S&P500? I sure hope so for yours and my sake as well. Plus the biggest question...where the fuck are you gonna live?

If you wanna go travel and experience the world just do it while you're young, don't try to make everything a cost-benefit decision based on shaky assumptions.

|

|  |  10-30-2024, 01:39 PM

10-30-2024, 01:39 PM

|

#33506 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,037

Thanked 2,758 Times in 1,070 Posts

Failed 256 Times in 73 Posts

| Quote:

Originally Posted by badgerx3  Yes, it does make sense from a math perspective only. However, have you considered the qualitative factors?

Do stonks only go up? Do you think you will not get priced out when you're ready to buy again? I am unsure of your relationship status, however do you foresee yourself purchasing of such magnitude with someone you've only been with for a couple of years?

If I was a single guy looking at my financial options, your train of thought is a good one. However, I think you need to look at the qualitative stuff to make a right decision for you. | I mean indexes only go up.

If TH/Duplexes go above $1.2-1.7M, I'd be priced out and I'll probably re-locate / ask for mom for downsize/help and she moves in.

If we enter the $2M+ for TH/Duplex, I'm can't afford to be here honestly, even $1.2-1.7M is a crazy stretch without help

Good point on whether you'd buy something so big and expensive with someone you've been dating < 3-5 years. Hard to say, I guess if you're popping kids, you might as well yolo the house too lol Quote:

Originally Posted by Hondaracer  Every single person I know who’s done this has no owned primary residence any longer lol.. like 4/4 of them thought the same thing and cost of living and cost of housing outpaced their plan and now they are all renting

It’s a risky game to play imo | Different generation though, your cohort probably bought 1BR for $300-500K, our generation is paying $550-750K.

Even detached in the burbs could be had < 5 -7 years ago $1.2-1.7M, we're looking at $2-2.5M.

My thought process is if I get priced out, 1beds start going for $675-900K, should be a sign that there's no economic feasible future for me here.

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

Last edited by Gerbs; 10-30-2024 at 01:44 PM.

|

|  |  10-30-2024, 01:45 PM

10-30-2024, 01:45 PM

|

#33507 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,037

Thanked 2,758 Times in 1,070 Posts

Failed 256 Times in 73 Posts

| Quote:

Originally Posted by CivicBlues  500/mo net is basically nothing with all the trouble you're probably likely going to break even if not lose. 20-24k in index gains based on what initial investment? After a 40% historic 1 year return in the S&P500? I sure hope so for yours and my sake as well. Plus the biggest question...where the fuck are you gonna live?

If you wanna go travel and experience the world just do it while you're young, don't try to make everything a cost-benefit decision based on shaky assumptions. | $300K Equity from sale @ 7-8% = $21-24K.

I was going to home base at my moms now that my brother moved out, then rent/wfh in various cities for $2.5-3K/month for 6mo - 2 years until I turn 30

I've lived alone from 24 - 28, it was fun but there's not much utility / character growth left for $36K/year in housing

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

|

|  |  10-30-2024, 02:09 PM

10-30-2024, 02:09 PM

|

#33508 | | RS.net, where our google ads make absolutely no sense!

Join Date: Nov 2012 Location: YVR

Posts: 944

Thanked 727 Times in 357 Posts

Failed 64 Times in 21 Posts

|

A guy I know was convinced by Garth Turner in 2016 and sold his house to try and time the market. The proceeds from the sale he dumped it into ETFs while it had growth + dividends it didnt come close to the tax free gains if he held onto his house. He had to go to Alberta to get back into a detached house.

YVR you can get priced out forever so beware.

|

|  |  10-30-2024, 02:14 PM

10-30-2024, 02:14 PM

|

#33509 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2014 Location: Van

Posts: 5,242

Thanked 2,185 Times in 1,171 Posts

Failed 221 Times in 133 Posts

|

There's also taxes on the 7% a year. So you're not making that much. Vs gains are tax free in your house. And I guess you can write off the heloc % too.

Honestly, unless you already own here, I don't really see why you would pay $2m for a duplex. The new builds duplex are already asking that in BBY. Do you really want to live in Chilliwack 10 years down the road? Just settle to Alberta, or if you can continue to work remote. Just move to another country since you have no kids, baggage.

Where do you see Canada in 10 years, the gov is sounding alarm bells for productivity, GDP per buddy guy. Do you really see lots of opportunities to succeed and big money in Canada in the next 10 years? Or do you think it's gonna continue to grind down and get worse. I don't see what Canada has that can make everyone on here all chateau owners if you don't already have money now, family money or own a place now. RE is not gonna get cheaper here theres no land. We can only subdivide and move upwards. Illegal labour isn't getting any cheaper.

|

|  |  10-30-2024, 02:23 PM

10-30-2024, 02:23 PM

|

#33510 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,037

Thanked 2,758 Times in 1,070 Posts

Failed 256 Times in 73 Posts

| https://www.reddit.com/r/PersonalFin...under_35_hits/

Homeowners under 35 median net worth $457,000

Non Homeowners under 35 median net worth $44,000 Quote:

Originally Posted by noclue  A guy I know was convinced by Garth Turner in 2016 and sold his house to try and time the market. The proceeds from the sale he dumped it into ETFs while it had growth + dividends it didnt come close to the tax free gains if he held onto his house. He had to go to Alberta to get back into a detached house.

YVR you can get priced out forever so beware. | SPY / $VFV is up almost 300% from $47 in 2016 vs $143 today

So if he sold for $1M in 2016, his ETF is $3M today. Should be able to buy back! Quote:

Originally Posted by JDMDreams  There's also taxes on the 7% a year. So you're not making that much. Vs gains are tax free in your house. And I guess you can write off the heloc % too. | On the 1-1.5% dividend sure, capital gains aren't taxed until you sell and both are taxed efficiently. Quote:

Originally Posted by JDMDreams  Honestly, unless you already own here, I don't really see why you would pay $2m for a duplex. The new builds duplex are already asking that in BBY. Do you really want to live in Chilliwack 10 years down the road? Just settle to Alberta, or if you can continue to work remote. Just move to another country since you have no kids, baggage. | For $2M Invested, I'd probably move to Japan/Taiwan where my friends are re-locating, withdraw 4% / $80K a year and live like a king. Consult on the side if I need more money. I don't spend much though lol

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

Last edited by Gerbs; 10-30-2024 at 02:30 PM.

|

|  |  10-30-2024, 02:32 PM

10-30-2024, 02:32 PM

|

#33511 | | linguistic ninja

Join Date: Aug 2001 Location: Vancouver, BC

Posts: 16,467

Thanked 4,412 Times in 1,580 Posts

Failed 145 Times in 83 Posts

| Quote:

Originally Posted by Gerbs  I mean indexes only go up.

| What is your time horizon? You are operating under the assumption that the S&P spits out a minimum of 7-8% a year when that's the average over 30+ years. So given we have had a runup this year alone of over 40% there's a chance you won't even see positive returns for a number of years let alone 7-8%. What happens if you did this at the start of 2022? You would have been in the red almost immediately and wouldn't have recovered until the start of this year. Are you willing to sit out of the housing market for 2+ years?

|

|  |  10-30-2024, 02:40 PM

10-30-2024, 02:40 PM

|

#33512 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2014 Location: Van

Posts: 5,242

Thanked 2,185 Times in 1,171 Posts

Failed 221 Times in 133 Posts

|

I agree with the time horizon, I think you need at least 10 years, min 5y to be safe. You're not gonna make 14% in two years and try to buy back. House prices will start to run back up next year with the rate cuts. Still no supply and pent up demand. What are your chances of hitting a magic stock and it doubles in the next 3 years. Especially added uncertainty with the stupid shit Trump will do if he wins.

|

|  |  10-30-2024, 02:46 PM

10-30-2024, 02:46 PM

|

#33513 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2014 Location: Van

Posts: 5,242

Thanked 2,185 Times in 1,171 Posts

Failed 221 Times in 133 Posts

|

$300000 barely doubles in 10y at 7%. After 10 year with no added money you are sitting at $590,145.41 which is barely a DP for detached. At 5y you're only at $420,765.52.

Even if you push that number to 10% you're at $778,122.74

|

|  |  10-30-2024, 05:41 PM

10-30-2024, 05:41 PM

|

#33514 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,037

Thanked 2,758 Times in 1,070 Posts

Failed 256 Times in 73 Posts

| Quote:

Originally Posted by CivicBlues  What is your time horizon? You are operating under the assumption that the S&P spits out a minimum of 7-8% a year when that's the average over 30+ years. So given we have had a runup this year alone of over 40% there's a chance you won't even see positive returns for a number of years let alone 7-8%. What happens if you did this at the start of 2022? You would have been in the red almost immediately and wouldn't have recovered until the start of this year. Are you willing to sit out of the housing market for 2+ years? | 10 years to forever, the goal with the equity portion side of business was always wait till it hits $1.5M then withdraw 4% forever and switch to p/t consulting or teaching.

However, I do wanna yolo a portion of $$$ if a good small business comes up for sale. It would be painful to have -18% like in 2022, but if that means the younger generation gets a chance to buy back into assets. So be it Quote:

Originally Posted by JDMDreams  $300000 barely doubles in 10y at 7%. After 10 year with no added money you are sitting at $590,145.41 which is barely a DP for detached. At 5y you're only at $420,765.52.

Even if you push that number to 10% you're at $778,122.74 | I'd invest the difference in savings to the equity portfolio every month. Estimating I could sack away $3.5-4.5K total per month, not factoring promotional salary bumps + additional consulting clients in the next decade.

10-years of contribution FV @ 8% would be around $637 - 819K + $778K by 38 = $1.6M, which hopefully is a 50% Downpayment on a $3M 1960's tear down.

Doesn't include current equity portfolio either

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

Last edited by Gerbs; 10-30-2024 at 05:51 PM.

|

|  |  10-30-2024, 06:46 PM

10-30-2024, 06:46 PM

|

#33515 | | y'all better put some respeck on my name

Join Date: Dec 2002 Location: Vancouver

Posts: 18,607

Thanked 9,789 Times in 2,539 Posts

Failed 393 Times in 159 Posts

| |

|  |  10-30-2024, 06:53 PM

10-30-2024, 06:53 PM

|

#33516 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 38,545

Thanked 15,449 Times in 6,244 Posts

Failed 2,115 Times in 722 Posts

|

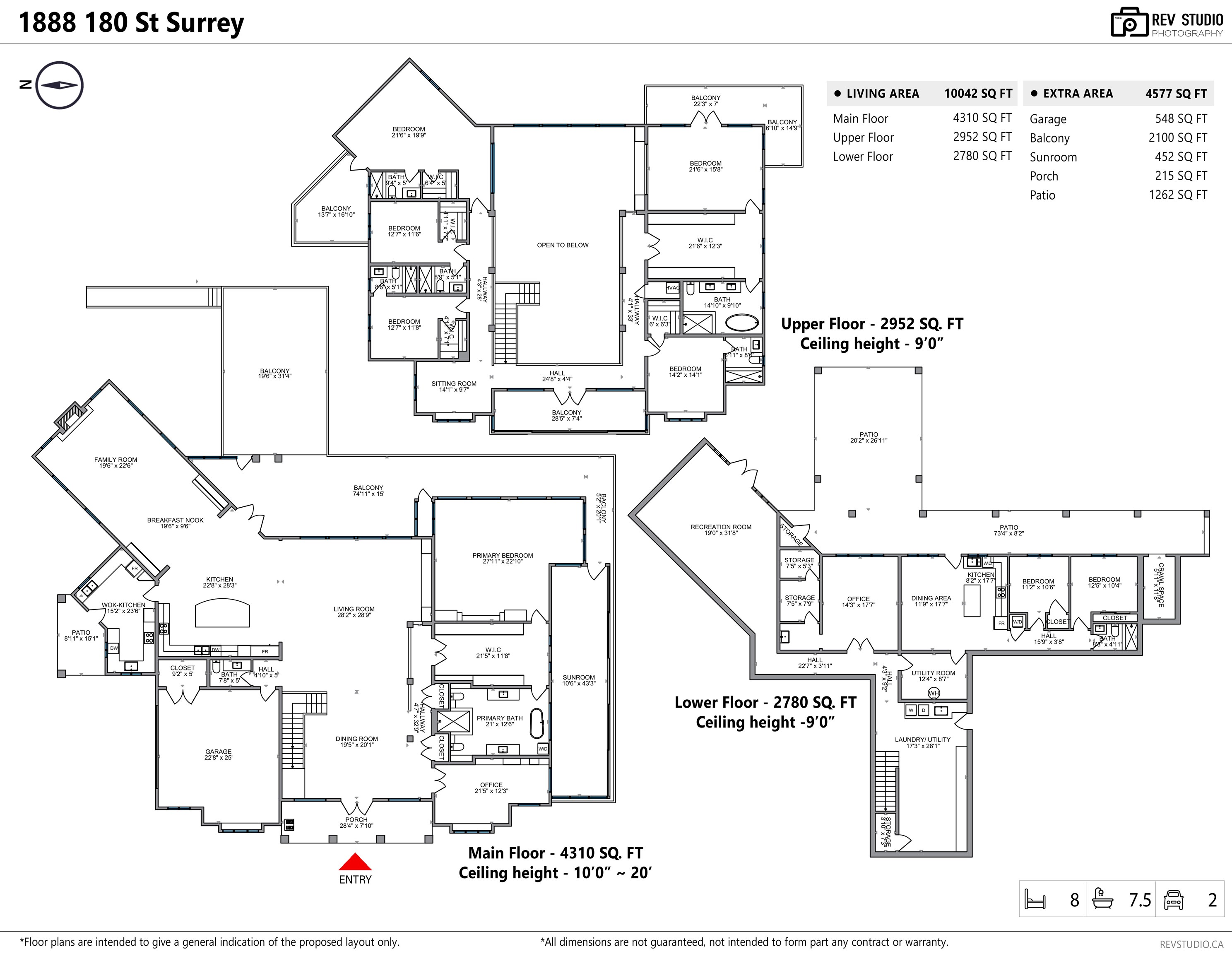

In a home that size.. you’ve got your laundry pair out in the open in the master ensuite?…

__________________

Dank memes cant melt steel beams

|

|  |  10-30-2024, 07:15 PM

10-30-2024, 07:15 PM

|

#33517 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2014 Location: Van

Posts: 5,242

Thanked 2,185 Times in 1,171 Posts

Failed 221 Times in 133 Posts

|

It doesn't look like a $6m house, it looks pretty worn and unkempt outside. Only assessed at $5.8 and why do you have to build that stupid j shape layout if you have so much space and have jank shaped rooms. You have a retard shaped bedroom, family room and kitchen. The front entrance and parking/ garage looks so cheap.  https://www.zealty.ca/mls-R2911754/1...NUE-Surrey-BC/ https://www.zealty.ca/mls-R2911754/1...NUE-Surrey-BC/

$400000 less and it actually looks $5m   |

|  |  10-30-2024, 08:20 PM

10-30-2024, 08:20 PM

|

#33518 | | Revscene.net has a homepage?!

Join Date: Jul 2015

Posts: 1,236

Thanked 1,126 Times in 541 Posts

Failed 4 Times in 4 Posts

| Quote:

Originally Posted by Hondaracer  In a home that size.. you’ve got your laundry pair out in the open in the master ensuite?… | I'm also baffled by the toilets on each side of the shower surrounded by glass enclosures. What scenario necessitates this kind of insane arrangement?

|

|  |  10-30-2024, 09:08 PM

10-30-2024, 09:08 PM

|

#33519 | | My dinner reheated before my turbo spooled

Join Date: Nov 2005 Location: bc

Posts: 1,709

Thanked 1,574 Times in 410 Posts

Failed 10 Times in 10 Posts

|

i dont care how comfortable you are with your s/o, there is no need for the both off you sitting on the shitter making eye contact

__________________

what 7 you say?!

|

|  |  10-30-2024, 09:18 PM

10-30-2024, 09:18 PM

|

#33520 | | Willing to sell body for a few minutes on RS

Join Date: Oct 2016 Location: Ricemond

Posts: 10,348

Thanked 12,152 Times in 4,360 Posts

Failed 500 Times in 258 Posts

|

What you don’t like battle shits in the morning ?!?

|

|  |  10-30-2024, 09:28 PM

10-30-2024, 09:28 PM

|

#33521 | | Need to Seek Professional Help

Join Date: Jan 2005 Location: Van

Posts: 1,063

Thanked 548 Times in 293 Posts

Failed 27 Times in 15 Posts

| Quote:

Originally Posted by Gerbs  https://www.reddit.com/r/PersonalFin...under_35_hits/

Homeowners under 35 median net worth $457,000

Non Homeowners under 35 median net worth $44,000

SPY / $VFV is up almost 300% from $47 in 2016 vs $143 today

So if he sold for $1M in 2016, his ETF is $3M today. Should be able to buy back!

On the 1-1.5% dividend sure, capital gains aren't taxed until you sell and both are taxed efficiently. | TBH, after reading your comments it looks like you are looking for an excuse to move away from Vancouver. You are already deeply considering it, but you want something else/someone else to make that decision for you.

If you're going to do this, you need to YOLO. If you are confident SPY will continue to grow, buy options, not shares.

|

|  |  10-30-2024, 09:29 PM

10-30-2024, 09:29 PM

|

#33522 | | linguistic ninja

Join Date: Aug 2001 Location: Vancouver, BC

Posts: 16,467

Thanked 4,412 Times in 1,580 Posts

Failed 145 Times in 83 Posts

|

Cool, His and Her sinks and toilets so you don't fight over it in the morning.

Or...watch an escort shower while you and the buddy you spit-roasted her with show dominance by taking concurrent dumps while you side-eye your mom when she comes in and does a load of your laundry.

Yeah I imagine that's what goes down in $6MM South Surrey mansions built on a former blueberry farm.

|

|  |  10-30-2024, 09:40 PM

10-30-2024, 09:40 PM

|

#33523 | | I subscribe to Revscene

Join Date: Mar 2005 Location: Vancouver

Posts: 1,913

Thanked 5,045 Times in 1,147 Posts

Failed 16 Times in 14 Posts

| Quote:

Originally Posted by Gerbs  We all plan to upgrade to duplex/TH ($5-7K/mo) in the next 3-5 years with future partner. | chicks love it when you have them on your spreadsheets.

__________________ Quote:

Originally Posted by westopher  replace that wood for who gets producer the wood. | |

|  |  10-30-2024, 09:56 PM

10-30-2024, 09:56 PM

|

#33524 | | RS.net, where our google ads make absolutely no sense!

Join Date: Jan 2007 Location: GVA

Posts: 914

Thanked 352 Times in 127 Posts

Failed 36 Times in 2 Posts

| Quote:

Originally Posted by Gerbs  Renewal is up in < 60 days, total housing costs will be close to $3K/month for a 20 year old 1BR in Van. If I rent my place, I can net $6K/year pre-tax. Equity can net around $20-24K/year average index gains.

A few of my friends are going full-equity and renting cheaper places. We all plan to upgrade to duplex/TH ($5-7K/mo) in the next 3-5 years with future partner. So there's no incentive to go from 1BR to 2/3BR.

I'm thinking about doing the same so I can be more mobile, try living in new areas and potentially new cities.

Anyone else liquidate their only PR for a short period of time? Everyone is saying no but math makes sense to me. | I mean, if you really want to be mobile and try living in new places and that is the primary motivation, OK. But if the primary motivation is financial I think it's risky if your goal is to "upgrade" in 3-5 years.

You are basically betting that an index will yield better than the appreciation of your 1BR relative to the appreciation of a duplex/TH over the next 2-3 years. There is a non-zero risk that the market goes down in that horizon. Meanwhile, if your goal is a duplex/TH in the next 2-3 years, even if the RE market slumps, so too will the price of that duplex/TH, so you're fine in a way. Further, nobody has a crystal ball, but in a climate where interest rates are going down, supply has been low for a while, etc... I think we are in a situation where prices are more likely to appreciate than depreciate.

Lastly, time passes fast and humans are creatures of habit. You may be more diligent than most, but it's very easy to say "Oh I'll rent for a couple years and then get back in the market" but for that 2 years to turn into 3, 5, 8, etc. I have doctor friends who certainly have the capital/income to buy a place that have ended up in that situation, simply because life gets busy and it's cost them (admittedly nobody cries for them, it just means they're buying addresses further east than they would have 5-6 years ago).

Last edited by carsncars; 10-30-2024 at 10:09 PM.

|

|  |  10-30-2024, 11:04 PM

10-30-2024, 11:04 PM

|

#33525 | | Willing to sell body for a few minutes on RS

Join Date: Aug 2002 Location: Vancouver

Posts: 10,357

Thanked 3,402 Times in 1,319 Posts

Failed 140 Times in 68 Posts

|

That 6.2M house in Surrey… whoever came up with the floor plan - what were they thinking?

__________________

Do Not Put Aftershave on Your Balls. -604CEFIRO

Looks like I'm gonna have some hot sex again tonight...OOPS i got the 6 pack. that wont last me the night, I better go back and get the 24 pack! -Turbo E

kinda off topic but obama is a dilf - miss_crayon

Honest to fucking Christ the easiest way to get a married woman in the mood is clean the house and do the laundry.....I've been with the same girl almost 17 years, ask me how I know. - quasi

|

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 02:15 AM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!