| Vancouver Off-Topic / Current Events The off-topic forum for Vancouver, funnies, non-auto centered discussions, WORK SAFE. While the rules are more relaxed here, there are still rules. Please refer to sticky thread in this forum. |

| |  01-22-2016, 02:58 AM

01-22-2016, 02:58 AM

|

#4576 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

| Quote:

Originally Posted by iEatClams  off topic

what you your guy's thoughts on currency hedging? I've heard hedging doesn't quite work properly. But with the CAD dollar the way it is.

Would it be better to buy a hedged ETF - especially if you are buying S&P 500 or Total US index? | don't do it, hedge naturally (own shares from around the world) and rebalance.

|

|  |  01-22-2016, 04:41 PM

01-22-2016, 04:41 PM

|

#4577 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

| Quote:

Originally Posted by Mr.C  ...or rent, and invest wisely. | people's attitude towards investing is the same with driving: i am better than the average person. statistics would say otherwise.

a house is a cornerstone of personal happiness and financial freedom when you finally pay off that mortgage.

|

|  |  01-25-2016, 04:23 AM

01-25-2016, 04:23 AM

|

#4578 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

|

An interesting read on the stupidity that is Vancouver real estate & Vancouver's, BC's, and Canada's elected officials' lack of willingness to even accept there is a problem: The illusion of home equity gains has weakened our will to act - The Globe and Mail

The illusion of home equity gains has weakened our will to act

Josh Gordon is an assistant professor in the Simon Fraser University School of Public Policy.

Vancouver is suffering a severe crisis of housing affordability. The historical standard of housing affordability has been a house-price-to-income ratio of three. At the peak of its housing bubble, the U.S. ratio was around five, where Canada as a whole sits today. Vancouver’s ratio currently exceeds 11.

While the existence of this crisis is not up for debate, common misunderstandings about the situation have weakened our political will to act.

Perhaps the most common misunderstanding is that this situation is a significant problem only for first-time buyers. In this view, existing homeowners are laughing all the way to the bank. This results in government inaction, as politicians dance around the mantra of “protecting housing equity.” Neither Premier Christy Clark nor Prime Minister Justin Trudeau have been able to resist this dodge, but a dodge it is.

Why? Because the affordability crisis carries four major drawbacks, and most of the purported benefits are short term or illusory. Consider each.

The first major drawback is that a generation is being shut out of home ownership in their own city. Home ownership has a range of benefits, from forced savings to a sense of stability to favourable tax treatment, and these are being denied to most younger Vancouverites. If they do want these benefits, most are forced to live far away from work, families and friends. And while some are able to look forward to a bigger inheritance, it won’t benefit them for many years. In the meantime, rents are also sharply increasing.

Second, the crisis has forced first-time buyers to leverage up dangerously in order to get into the market. This is inevitably followed by deleveraging when unrealistic prices stop rising and people scramble to pay down onerous debt. By failing to pop the bubble now, policy-makers are simply setting us up for a worse shock later.

Third, much of the crisis is being driven by foreign money, which is evident to anyone without a vested interest. This has led to weaker communities, as those with little connection to the city make little effort to integrate and foreign investors’ homes sit empty.

Finally, the crisis is threatening the region’s long-term economic viability, even as it produces a short-term growth boost. Many young professionals are forced to go elsewhere, draining Vancouver of entrepreneurship and talent. Conversely, entrepreneurs have a hard time attracting young talent. As a result, economic activity and investment is pushed into consumption industries, such as luxury goods and high-end restaurants. The productive investment and social infrastructure needed for the city’s future are neglected.

These drawbacks are set against the main supposed benefit of this situation: high and rising home equity.

But home equity is not like other types of wealth because housing is a positional good. If your stock portfolio goes up 30 per cent, you can cash it out and spend it. But if your house value goes up 30 per cent, then so do the values of most of the properties around you. If you want to cash out, you have to move to another city where prices haven’t gone up. Most Vancouverites don’t want to move away – so what have they gained?

In short, the people benefiting from higher home equity are far fewer than commonly assumed. Apart from real estate agents, developers and construction firms, the main beneficiaries are those who want to draw down wealth against a home, those who want to downsize from detached housing to condos (whose prices have gone up less) and those who want to move out of the city altogether.

The first group are reckless, given the fickleness of property bubbles. The second will likely have gained massively from two decades of strong price growth, so a partial correction is no great worry. The third group should not be a significant concern for policy-makers with Vancouver in mind.

This all adds up to a strong case for action. Inaction is the product of political cowardice because provincial and federal leaders have real policy options. Taxes on short-term speculation have been proposed by Vancouver Mayor Gregor Robertson and restrictions on foreign ownership are common in places exposed to large foreign capital flows. In addition, professors at Simon Fraser University and the University of British Columbia have recently recommended a high-end property surtax, deductible against income tax contributions, targeting foreign investors.

Yet politicians are concerned that the short-term hit to economic growth (and tax revenue) will harm their political fortunes. But since when did we ask political leaders to knowingly allow bubbles to inflate, consequences be damned?

Last edited by 4444; 01-25-2016 at 04:29 AM.

|

|  |  01-25-2016, 04:28 AM

01-25-2016, 04:28 AM

|

#4579 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

| Quote:

Originally Posted by Carl Johnson  people's attitude towards investing is the same with driving: i am better than the average person. statistics would say otherwise.

a house is a cornerstone of personal happiness and financial freedom when you finally pay off that mortgage. | i can't agree more on the first (why do people even try to beat the indexes (we all try, we all fail, we call those opportunity losses 'education'), 60/40 split, diversify, rebalance, you will make in region of 7% p.a. nominal returns on average with immediate liquidity)

As for a house being the cornerstone of personal happiness and financial freedom, that shows the stupidity of average people. does this mean you have no happiness or financial freedom during the 30 years you are paying off your mortgage (and at the same time loads of interest)?

Those are your 30 best years of health and free cash time - live life, don't fuck yourself over with real estate (if you can afford it, sure that's fine, but most in Vancouver can't).

|

|  |  01-25-2016, 09:33 AM

01-25-2016, 09:33 AM

|

#4580 | | My homepage has been set to RS

Join Date: May 2002 Location: Vancouver

Posts: 2,370

Thanked 1,874 Times in 604 Posts

Failed 217 Times in 88 Posts

|

^4444, please don't ever come back to Vancouver. You respond to people's POV like a dick. Does it make you feel kool making arrogant obnoxious comments? I guess you can't get slapped from a keyboard.

__________________

16 GT3 RS

11 R8 V10

17 Long beach blue M2

86 944 Turbo with 340rwhp Lindsay Racing kit

15 991 PTS GT3

18 VW Golf R

|

|  |  01-25-2016, 09:38 AM

01-25-2016, 09:38 AM

|

#4581 | | I told him no, what y'all do?

Join Date: Aug 2006 Location: Vancouver

Posts: 10,653

Thanked 6,391 Times in 2,812 Posts

Failed 108 Times in 70 Posts

|

4444 - if those that are not finance/investment savvy, what do you suggest they do? hire a financial planner? would you say those that fall in to that bracket and decide to buy a vancouver home are as you stated above, or are they not as bad as they are at least "not jumping in to the deep end of the pool knowing they have no idea how to swim", or are they in fact jumping in by putting all their eggs in that 1 basket (even though they are living in it? would like to know your thoughts on this.

__________________ Feedback

http://www.revscene.net/forums/showthread.php?t=611711 Quote: Greenstoner

1 rat shit ruins the whole congee

originalhypa

You cannot live the life of a whore and expect a monument to your chastity | Quote:

[22-12, 08:51]mellomandidnt think and went in straight..scrapped like a bitch

[17-09, 12:07]FastAnna glowjob

[17-09, 12:08]FastAnna I like dat

| |

|  |  01-25-2016, 09:40 AM

01-25-2016, 09:40 AM

|

#4582 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 39,479

Thanked 16,089 Times in 6,561 Posts

Failed 2,165 Times in 747 Posts

|

The argument of "renting and investing wisely" has been brought up with many very successful people I know, in the end their response it typically the same. Even with good connections within the market and financial guidance, they've been more down than up in the long run with their investments.

Real estate on the other hand, none of them have lost in the last 30 years.

__________________

Dank memes cant melt steel beams

|

|  |  01-25-2016, 10:15 AM

01-25-2016, 10:15 AM

|

#4583 | | My homepage has been set to RS

Join Date: Aug 2002 Location: AB/BC

Posts: 2,246

Thanked 1,223 Times in 393 Posts

Failed 26 Times in 10 Posts

|

1985 average Vancouver house $112000??

Current avg 1.2million??

1985 s&p500 starting with 112000

Dividends reinvested over 30 years =8.2% per year

Current value 1.2million??

Both are good

|

|  |  01-25-2016, 10:30 AM

01-25-2016, 10:30 AM

|

#4584 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2001

Posts: 5,158

Thanked 2,723 Times in 1,223 Posts

Failed 81 Times in 54 Posts

| Quote:

Originally Posted by 4444

Those are your 30 best years of health and free cash time - live life, don't fuck yourself over with real estate (if you can afford it, sure that's fine, but most in Vancouver can't).

| I don't know about you, but I'm happy when I see my wife comfortable in a home that we can call our own. And a happy wife is a huge determinant of my health, my emotional well-being, and ultimately, my career trajectory and future ability to create and preserve wealth.

|

|  |  01-25-2016, 10:50 AM

01-25-2016, 10:50 AM

|

#4585 | | SFICC-03*

Join Date: Mar 2002 Location: richmond

Posts: 9,293

Thanked 4,034 Times in 1,588 Posts

Failed 166 Times in 87 Posts

| Quote:

Originally Posted by Hondaracer  The argument of "renting and investing wisely" has been brought up with many very successful people I know, in the end their response it typically the same. Even with good connections within the market and financial guidance, they've been more down than up in the long run with their investments.

Real estate on the other hand, none of them have lost in the last 30 years. | the s&p has been outperforming even vancouver's detached home market in the last 30 years after both have been adjusted for inflation. not all investors win but many do.

|

|  |  01-25-2016, 11:05 AM

01-25-2016, 11:05 AM

|

#4586 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2001

Posts: 5,158

Thanked 2,723 Times in 1,223 Posts

Failed 81 Times in 54 Posts

| Quote:

Originally Posted by unit  the s&p has been outperforming even vancouver's detached home market in the last 30 years after both have been adjusted for inflation. not all investors win but many do. | I would imagine that real estate has outperformed investments for many people because management fees from traditional products, such as mutual funds, have made significant dents in returns.

The popularity of index investing for the masses, low-cost brokerages, and robo-advisors are changing the game.

|

|  |  01-25-2016, 11:10 AM

01-25-2016, 11:10 AM

|

#4587 | | RS controls my life!

Join Date: Jan 2002

Posts: 713

Thanked 42 Times in 32 Posts

Failed 5 Times in 5 Posts

| Quote:

Originally Posted by sdubfid  1985 average Vancouver house $112000??

Current avg 1.2million??

1985 s&p500 starting with 112000

Dividends reinvested over 30 years =8.2% per year

Current value 1.2million??

Both are good | Yes but in 1985 would you take out a mortgage just to buy into s&p500?

Dont forget about paying for rent.

On the flip side your house has already been paid off. Live rent free or rent it out and collect monthly.

|

|  |  01-25-2016, 12:18 PM

01-25-2016, 12:18 PM

|

#4588 | | OMGWTFBBQ is a common word I say everyday

Join Date: Dec 2002 Location: YVR/TPE

Posts: 5,143

Thanked 3,220 Times in 1,418 Posts

Failed 676 Times in 219 Posts

|

For those looking into passive investments as a renter, I'd suggest looking into very stable dividend stocks.

My uncle in Taiwan isn't exactly investment savvy, so he invests into CHT (Chunghwa Telecom) and TSM (TSMC) whenever they dip below a certain trend line. (of course saving all his disposable income in the mean time)

He averages out around 7% ROI yearly and he has amassed a few mil worth of shares in both companies throughout the last 2 decades. He pretty much never sell his shares.

Key points on why he puts in these 2 companies: both dominate in the market they are in, with no foreseeable problem in their long term growth/operation/finance/competition.

__________________

Nothing for now

|

|  |  01-25-2016, 12:39 PM

01-25-2016, 12:39 PM

|

#4589 | | I HERP TO YOU DERP

Join Date: Oct 2004 Location: 604

Posts: 1,190

Thanked 235 Times in 103 Posts

Failed 12 Times in 6 Posts

|

no point in measuring dicks on an online forum or even in real life

everyone has their own personal investment theology and mistakes always happen

live and learn and progress through life

funny how we human beings like to boast to the people we hate or dont know the most  |

|  |  01-25-2016, 03:51 PM

01-25-2016, 03:51 PM

|

#4590 | | Even when im right, revscene.net is still right!

Join Date: Aug 2010 Location: Richmond

Posts: 1,349

Thanked 1,776 Times in 444 Posts

Failed 195 Times in 67 Posts

|

Just to clarify my point, I'm not a 'rent always, buying sucks' kind of person. However, the rent ratio in the Lower Mainland is SHIT.

Here's an easy way to visualize it: http://www.nytimes.com/interactive/2...ator.html?_r=0

A house like the one I live in is worth roughly 1.5 mil. Even with an extremely optimistic outlook that homes will continue to rise in price 7% a year, it's still cheaper to rent if the rent is under 3k or so. If it's in a 3 mil house, my rent can be under 6k. I can rent a 3 mil house for 4k in Vancouver. Or a 6 mil house for 6k. Right now, I'd be putting an extra 10k vs buying in my pocket. Hypothetically, if I could afford to live in a 3 mil house, it would be an extra 24k. In a 6 mil house? 72k.

"Honey, if we rent we can have an extra 10k/yr in the bank"... Doesn't sound like a hard sell to the wife.

Edit:

Here's a quick oranges to mandarins comparison:

Massive house off of Angus Dr, 5800/month http://vancouver.craigslist.ca/van/apa/5393948165.html

Similar house, a block away, 7 mil https://www.realtor.ca/Residential/S...olumbia-V6M3P4

Last edited by Mr.C; 01-25-2016 at 03:59 PM.

|

|  |  01-25-2016, 04:05 PM

01-25-2016, 04:05 PM

|

#4591 | | My dinner reheated before my turbo spooled

Join Date: Oct 2002 Location: vancouver

Posts: 1,766

Thanked 640 Times in 242 Posts

Failed 12 Times in 9 Posts

| Quote:

Originally Posted by Mr.C

"Honey, if we rent we can have an extra 10k/yr in the bank"... Doesn't sound like a hard sell to the wife.

| Don't forget the

"Honey, the landlord called and said they are not renewing our lease we have to move in 3 months"  |

|  |  01-25-2016, 04:22 PM

01-25-2016, 04:22 PM

|

#4592 | | Willing to sell body for a few minutes on RS

Join Date: Aug 2004 Location: Duncan, BC

Posts: 10,128

Thanked 5,568 Times in 2,107 Posts

Failed 231 Times in 90 Posts

| Quote:

Originally Posted by Mr.C  Just to clarify my point, I'm not a 'rent always, buying sucks' kind of person. However, the rent ratio in the Lower Mainland is SHIT.

Here's an easy way to visualize it: http://www.nytimes.com/interactive/2...ator.html?_r=0

A house like the one I live in is worth roughly 1.5 mil. Even with an extremely optimistic outlook that homes will continue to rise in price 7% a year, it's still cheaper to rent if the rent is under 3k or so. If it's in a 3 mil house, my rent can be under 6k. I can rent a 3 mil house for 4k in Vancouver. Or a 6 mil house for 6k. Right now, I'd be putting an extra 10k vs buying in my pocket. Hypothetically, if I could afford to live in a 3 mil house, it would be an extra 24k. In a 6 mil house? 72k.

"Honey, if we rent we can have an extra 10k/yr in the bank"... Doesn't sound like a hard sell to the wife.

Edit:

Here's a quick oranges to mandarins comparison:

Massive house off of Angus Dr, 5800/month 5 BR House for Rent, Magee & Point Grey Secondary Kerrisdale

Similar house, a block away, 7 mil https://www.realtor.ca/Residential/S...olumbia-V6M3P4 | e-valueBC

Assessed at $3.4M, sold for $3.1M 16 months ago.

$7M house is assessed at $4.9M with an unfinished building (finished after July 1, obviously).

|

|  |  01-25-2016, 04:40 PM

01-25-2016, 04:40 PM

|

#4593 | | SFICC-03*

Join Date: Mar 2002 Location: richmond

Posts: 9,293

Thanked 4,034 Times in 1,588 Posts

Failed 166 Times in 87 Posts

|

rent vs buy is not that simple, sometimes you win with one sometimes you win with the other.

there are some good calculators out there that can show you when you come out on top with one vs the other.

of course its not always that accurate because there are a lot of factors it can't predict, such as interest rates or market performance.

still, it's neat to play with and will give you an idea of how certain factors should influence your decision.

|

|  |  01-25-2016, 05:28 PM

01-25-2016, 05:28 PM

|

#4594 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

| Quote:

Originally Posted by 4444  An interesting read on the stupidity that is Vancouver real estate & Vancouver's, BC's, and Canada's elected officials' lack of willingness to even accept there is a problem: The illusion of home equity gains has weakened our will to act - The Globe and Mail

The illusion of home equity gains has weakened our will to act

Josh Gordon is an assistant professor in the Simon Fraser University School of Public Policy.

Vancouver is suffering a severe crisis of housing affordability. The historical standard of housing affordability has been a house-price-to-income ratio of three. At the peak of its housing bubble, the U.S. ratio was around five, where Canada as a whole sits today. Vancouver’s ratio currently exceeds 11.

While the existence of this crisis is not up for debate, common misunderstandings about the situation have weakened our political will to act.

Perhaps the most common misunderstanding is that this situation is a significant problem only for first-time buyers. In this view, existing homeowners are laughing all the way to the bank. This results in government inaction, as politicians dance around the mantra of “protecting housing equity.” Neither Premier Christy Clark nor Prime Minister Justin Trudeau have been able to resist this dodge, but a dodge it is.

Why? Because the affordability crisis carries four major drawbacks, and most of the purported benefits are short term or illusory. Consider each.

The first major drawback is that a generation is being shut out of home ownership in their own city. Home ownership has a range of benefits, from forced savings to a sense of stability to favourable tax treatment, and these are being denied to most younger Vancouverites. If they do want these benefits, most are forced to live far away from work, families and friends. And while some are able to look forward to a bigger inheritance, it won’t benefit them for many years. In the meantime, rents are also sharply increasing.

Second, the crisis has forced first-time buyers to leverage up dangerously in order to get into the market. This is inevitably followed by deleveraging when unrealistic prices stop rising and people scramble to pay down onerous debt. By failing to pop the bubble now, policy-makers are simply setting us up for a worse shock later.

Third, much of the crisis is being driven by foreign money, which is evident to anyone without a vested interest. This has led to weaker communities, as those with little connection to the city make little effort to integrate and foreign investors’ homes sit empty.

Finally, the crisis is threatening the region’s long-term economic viability, even as it produces a short-term growth boost. Many young professionals are forced to go elsewhere, draining Vancouver of entrepreneurship and talent. Conversely, entrepreneurs have a hard time attracting young talent. As a result, economic activity and investment is pushed into consumption industries, such as luxury goods and high-end restaurants. The productive investment and social infrastructure needed for the city’s future are neglected.

These drawbacks are set against the main supposed benefit of this situation: high and rising home equity.

But home equity is not like other types of wealth because housing is a positional good. If your stock portfolio goes up 30 per cent, you can cash it out and spend it. But if your house value goes up 30 per cent, then so do the values of most of the properties around you. If you want to cash out, you have to move to another city where prices haven’t gone up. Most Vancouverites don’t want to move away – so what have they gained?

In short, the people benefiting from higher home equity are far fewer than commonly assumed. Apart from real estate agents, developers and construction firms, the main beneficiaries are those who want to draw down wealth against a home, those who want to downsize from detached housing to condos (whose prices have gone up less) and those who want to move out of the city altogether.

The first group are reckless, given the fickleness of property bubbles. The second will likely have gained massively from two decades of strong price growth, so a partial correction is no great worry. The third group should not be a significant concern for policy-makers with Vancouver in mind. This all adds up to a strong case for action. Inaction is the product of political cowardice because provincial and federal leaders have real policy options. Taxes on short-term speculation have been proposed by Vancouver Mayor Gregor Robertson and restrictions on foreign ownership are common in places exposed to large foreign capital flows. In addition, professors at Simon Fraser University and the University of British Columbia have recently recommended a high-end property surtax, deductible against income tax contributions, targeting foreign investors.

Yet politicians are concerned that the short-term hit to economic growth (and tax revenue) will harm their political fortunes. But since when did we ask political leaders to knowingly allow bubbles to inflate, consequences be damned? | personally know someone who've bought and sold their house in a span of 6 years for over $1,000,000 gain. because it is their principal residence even though they have are really "astronauts" flying here and back to china very often, they don't have to pay a single penny. also know someone who didn't meet in required day you have to stay in BC to eligible to healthcare, yet she still had a baby here and is collecting child benefits meanwhile working in china.

introducing a tax new just on the most expensive property doesn't address the fundamental issue that there are major loopholes in our tax, healthcare, educational system that are being abused. you want to cool the property market? get ride of principal residence and introduce a tax system like in California where individual get 250k exemption on the gain and couple gets 500k.

by the way, i would be very skeptical about any UBC economist coming out sounding any alarm about vancouver property market given the amount of money they are taking in in their sauder real estate division.

Last edited by Carl Johnson; 01-25-2016 at 05:34 PM.

|

|  |  01-25-2016, 06:11 PM

01-25-2016, 06:11 PM

|

#4595 | | WOAH! i think Vtec just kicked in!

Join Date: Apr 2004 Location: Vancouver

Posts: 1,687

Thanked 731 Times in 294 Posts

Failed 76 Times in 29 Posts

| Quote:

Originally Posted by sdubfid  1985 average Vancouver house $112000??

Current avg 1.2million??

1985 s&p500 starting with 112000

Dividends reinvested over 30 years =8.2% per year

Current value 1.2million??

Both are good | While this may be true. what about the next 20 years?

Will Vancouver real estate go up 8% per year, or the S&P 500. No one really knows, but I think the latter is more likely.

|

|  |  01-25-2016, 06:38 PM

01-25-2016, 06:38 PM

|

#4596 | | Pull Out Towing. Women rescued for free.

Join Date: Mar 2002 Location: Hongcouver

Posts: 8,449

Thanked 2,414 Times in 1,283 Posts

Failed 128 Times in 71 Posts

| Quote:

Originally Posted by Jmac  e-valueBC

Assessed at $3.4M, sold for $3.1M 16 months ago.

$7M house is assessed at $4.9M with an unfinished building (finished after July 1, obviously). | House for rent (6688 Cypress st) was also built in 1995 whereas the $7M house is brand new.

The house is only valued at $906K

6668 Cypress St. built in 1996 sold for $3.578M on June 1.

House is valued at $1.1M

This one would be a better comparison vs the $7M house.

BTW, the $7M house is sitting on a 54x139 lot while the 2 Cypress houses are on 50x130 lots.

That being said, Mr.C, it's also not a fair comparison when comparing houses that are obviously beyond a lot of people's means.

__________________ Originally posted by Iceman_19 you should have tried to touch his penis. that really throws them off. Originally posted by The7even SumAznGuy > Billboa Originally posted by 1990TSI SumAznGuy> Internet > tinytrix Quote:

Originally Posted by tofu1413  and icing on the cake, lady driving a newer chrysler 200 infront of me... jumped out of her car, dropped her pants, did an immediate squat and did probably the longest public relief ever...... steam and all. | (11-0-0) Buy/Sell rating Christine Shitvic Pull Out Towing

Last edited by SumAznGuy; 01-25-2016 at 06:44 PM.

|

|  |  01-25-2016, 09:43 PM

01-25-2016, 09:43 PM

|

#4597 | | Even when im right, revscene.net is still right!

Join Date: Jan 2013 Location: Vancouver

Posts: 1,387

Thanked 640 Times in 205 Posts

Failed 103 Times in 22 Posts

|

Are we factoring in rent increases?

In 2012 renting 500-700 sq ft 1 bedroom in downtown is about $1500. In 2016, good luck finding anything decent (10 year old buildings) in downtown for less than $2000.

|

|  |  01-25-2016, 09:52 PM

01-25-2016, 09:52 PM

|

#4598 | | Even when im right, revscene.net is still right!

Join Date: Aug 2010 Location: Richmond

Posts: 1,349

Thanked 1,776 Times in 444 Posts

Failed 195 Times in 67 Posts

| Quote:

Originally Posted by Special K  Are we factoring in rent increases?

In 2012 renting 500-700 sq ft 1 bedroom in downtown is about $1500. In 2016, good luck finding anything decent (10 year old buildings) in downtown for less than $2000. | There's a few: vancouver, BC apts/housing for rent "coal harbour" - craigslist |

|  |  01-25-2016, 09:53 PM

01-25-2016, 09:53 PM

|

#4599 | | Old School RS

Join Date: May 2004 Location: Port Moody

Posts: 4,641

Thanked 4,157 Times in 1,262 Posts

Failed 130 Times in 80 Posts

| Quote:

Originally Posted by Mr.C  A house like the one I live in is worth roughly 1.5 mil. Even with an extremely optimistic outlook that homes will continue to rise in price 7% a year, it's still cheaper to rent if the rent is under 3k or so.

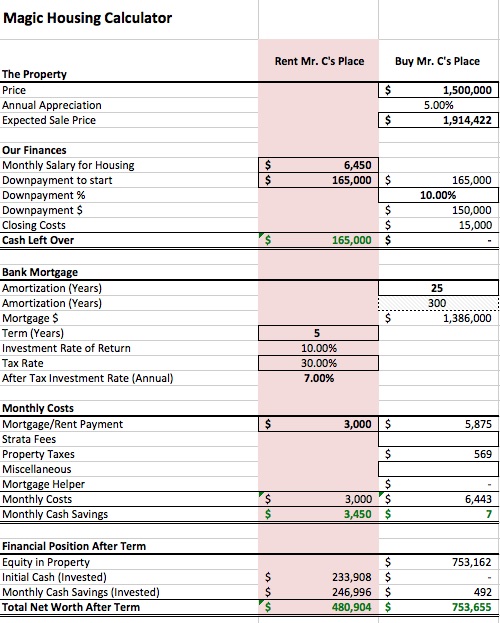

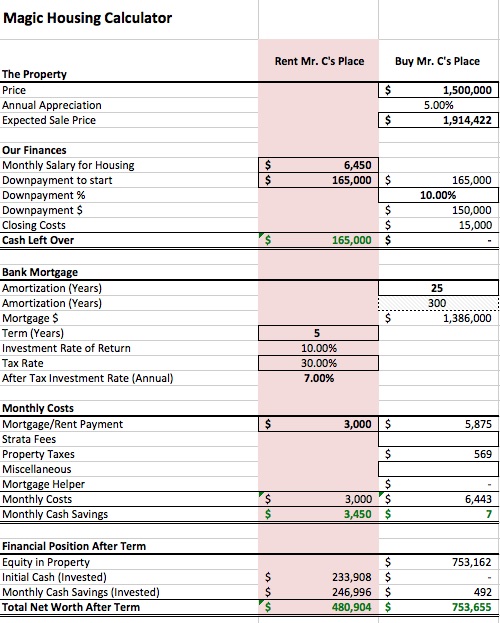

"Honey, if we rent we can have an extra 10k/yr in the bank"... Doesn't sound like a hard sell to the wife. | With all due respect, I don't think your math is correct. We recently analyzed this very decision (I'm an ex-accountant, now banker)... I've attached a screenshot of my spreadsheet adjusted for the figures you have proposed.

Assumptions:

1) Purchase price $1.5MM, 5.0% increase in value per year

2) High ratio mortgage with only 10% down, or $150K down payment, so CHMC insurance is required, costs added to the mortgage

3) I have assumed a 10% rate of return on your investment portfolio, which is pretty generous, and given a tax rate of only 30%

4) You have $165k down payment available and $6450/month available to either pay for housing or save

My spreadsheet operates on the assumption that if you rent a place, you immediately invest your whole down payment that you would have spent, and every month you invest the amount you save from renting into the same investment, all earning 7.0% after-tax. If you rent: total net worth after 5 years of $481k

Your $165k you had saved up for a down payment is worth $234k after 5 years.

Your $3,450 per month that your rent was cheaper than owning, which you invested each month, is worth $247k after 5 years. If you bought: total net worth after 5 years of $754k

Your $1.5MM house at 5% growth per year, over 5 years, is now a $1.9MM house. Your $1.4MM mortgage has been paid down to $1.16MM. The equity in your house, which is your net worth, is $754k.

I will be the first to say, there are a great number of assumptions, and in my own case, the outcome was not as great as I did not assume as high of a growth on the housing. But when I did sensitivity testing, considering interest rate increases, flat housing prices, etc. I still came to the conclusion that for our apartment in Port Moody (all markets may not behave the same), there really was no circumstance that made it likely financially superior to rent.

Hope this helps,

Mark

__________________

I'm old now - boring street cars and sweet race cars. |

|  |  01-25-2016, 10:08 PM

01-25-2016, 10:08 PM

|

#4600 | | Even when im right, revscene.net is still right!

Join Date: Aug 2010 Location: Richmond

Posts: 1,349

Thanked 1,776 Times in 444 Posts

Failed 195 Times in 67 Posts

|

Not bad, but a few questions:

- What interest rate did you assume for that? Mortgages are very top heavy in interest, as you know, especially with a 10% down payment.

- There are no maintenance or repair costs factored in, either (which for me is zero, since I rent).

- If you sell the house at 1.9mm, you're taking a $133,000 hit in realtor fees. The 753 goes down to 620...

- While 10% is a reasonably conservative investment rate, 5% a year property value increases is not.

I understand your post, but I think the numbers are a lot closer than the spreadsheet shows.

|

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 12:59 PM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!