| Vancouver Off-Topic / Current Events The off-topic forum for Vancouver, funnies, non-auto centered discussions, WORK SAFE. While the rules are more relaxed here, there are still rules. Please refer to sticky thread in this forum. |

| |  09-03-2013, 06:48 PM

09-03-2013, 06:48 PM

|

#1076 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 38,660

Thanked 15,516 Times in 6,276 Posts

Failed 2,119 Times in 724 Posts

|

4444 it's funny you mention the suns orientation as a main buying point

I work for a construction management company who builds almost only 3 level townhomes, our current project the buildings face east-west, however almost all the decks are on the insides of the units therefore of 25-30 units on one street they only see the sun for MAYBE 3 hours a day

I asked the sales girls the other day if anyone ever asks about the sun because working there constantly I know exactly which units do and do not get it, she said only one person of the 35 buyers as of yet has ever asked when and where the sun hits

Crazy to think the majority of the units you would never see the sun except for weekends if you work 9-5

Edit* was gonna say this is also a huge thing for me but mostly because I know things to look for and what I personally want

Posted via RS Mobile |

|  |  09-03-2013, 06:52 PM

09-03-2013, 06:52 PM

|

#1077 | | Banned By Establishment

Join Date: Dec 2003 Location: New West

Posts: 3,998

Thanked 2,982 Times in 1,135 Posts

Failed 284 Times in 109 Posts

|

Cue the quote I cam to put in.

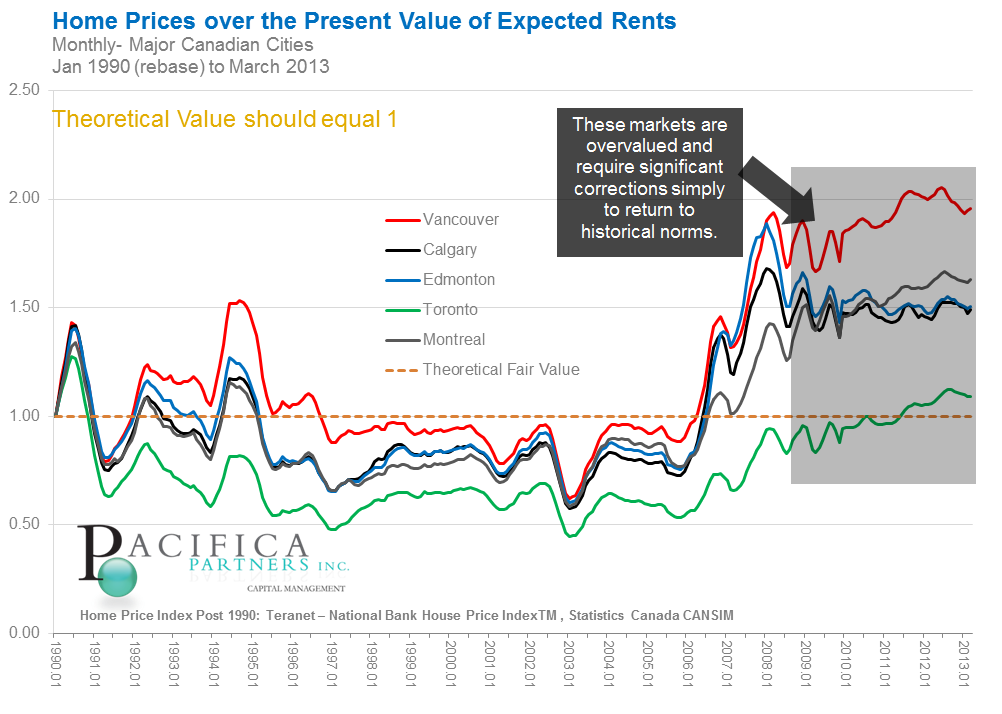

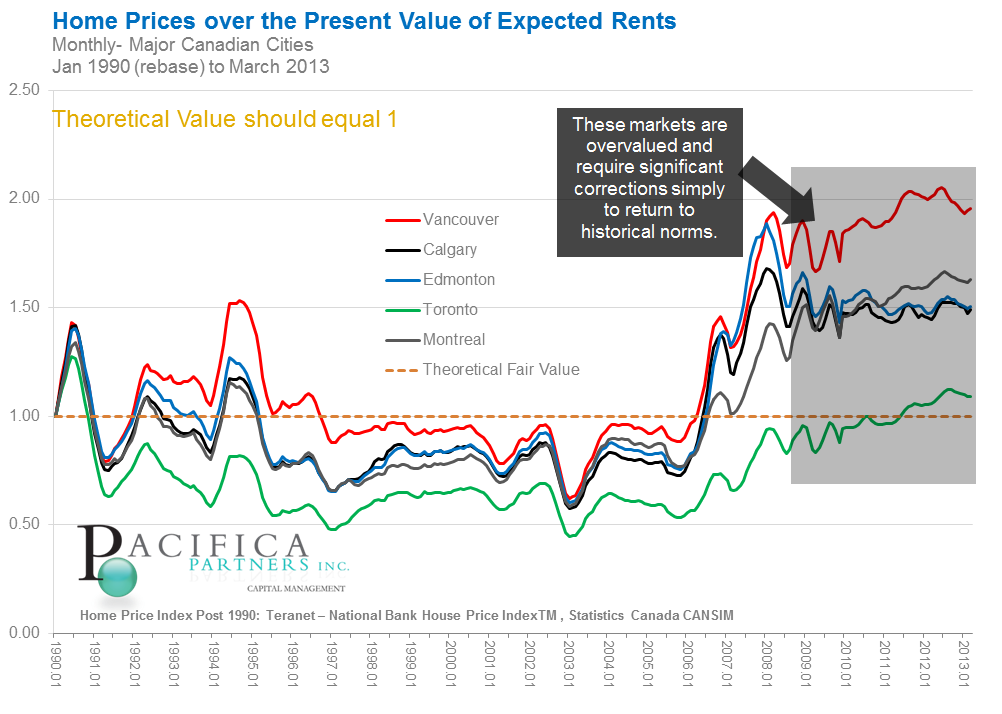

"Our houses, says The Economist, are overvalued by 30% in terms of what we can actually afford, and 74% compared to what they rent for."

That's a Canada average that The Economist is looking at. Vancouver is even worse.

|

|  |  09-03-2013, 07:47 PM

09-03-2013, 07:47 PM

|

#1078 | | resident Oil Guru

Join Date: Mar 2005 Location: Vancouver

Posts: 7,716

Thanked 10,457 Times in 1,794 Posts

Failed 1,065 Times in 267 Posts

| Quote:

Originally Posted by Gridlock  Cue the quote I cam to put in.

"Our houses, says The Economist, are overvalued by 30% in terms of what we can actually afford, and 74% compared to what they rent for."

That's a Canada average that The Economist is looking at. Vancouver is even worse. | Yeah, but that depends on who you talk to...  |

|  |  09-03-2013, 08:18 PM

09-03-2013, 08:18 PM

|

#1079 | | WOAH! i think Vtec just kicked in!

Join Date: Apr 2004 Location: Vancouver

Posts: 1,687

Thanked 731 Times in 294 Posts

Failed 76 Times in 29 Posts

| Quote:

Originally Posted by dvst8  I would agree that the 1980s were built better but you'll have to take in the fact that its 30+ years of wear and tear versus something built more recent with limited use. Really depends if the owners took care of the house | houses nowadays should be better due to increases in technology and advancements. But the issue you have today is that with the housing market booming, just like how everyone can become a realtor - where you have many many people that are terrible at it - everyone now is a developer. So you have guys that don't due proper work or just want to get the job done as fast as you can and move on to the next project while doing the most minimal work and do the minimal to get past inspectors.

Some of the houses I see being built wont last 40 + years like many of the older homes in the 70s and 80s that were built to last. I can see molding issues down the line. But by then the original builders wont be around and wont care.

Then you also have contractors that have sub-contracts that hire guys straight up cash and dont follow all the codes. Like realtors, there are good ones and bad ones, when the market is great, the bad realtors can get away with it and make $, same with developers/contractors.

|

|  |  09-08-2013, 07:58 AM

09-08-2013, 07:58 AM

|

#1080 | | resident Oil Guru

Join Date: Mar 2005 Location: Vancouver

Posts: 7,716

Thanked 10,457 Times in 1,794 Posts

Failed 1,065 Times in 267 Posts

| Quote:

Originally Posted by Gridlock  Cue the quote I cam to put in.

"Our houses, says The Economist, are overvalued by 30% in terms of what we can actually afford, and 74% compared to what they rent for."

That's a Canada average that The Economist is looking at. Vancouver is even worse. | Vancouver house sales roar back - The Globe and Mail  |

|  |  09-08-2013, 08:57 AM

09-08-2013, 08:57 AM

|

#1081 | | Banned By Establishment

Join Date: Dec 2003 Location: New West

Posts: 3,998

Thanked 2,982 Times in 1,135 Posts

Failed 284 Times in 109 Posts

|

^^Oh I get it. I've seen it just driving around my own neighborhood. Sold! Sold!

A power realtor couple named Eric And Julia Vallee will be vacationing well in Mexico this year.

But in that article, we're not mentioning that the rates ARE rising, they actually say, "does a 4 month streak now represent a new stability?" Are you fucking high? Housing prices are never going to be higher(in the foreseeable future) and rates are never going to be so low short of economic apocolypse 2.0.

The government itself is doing everything it can short of causing an 'e-pocolypse' to make housing more expensive, and less desirable.

Fantastic if you are left in a place where you can buy a house for less than 200k...but not cool here.

|

|  |  09-10-2013, 03:26 PM

09-10-2013, 03:26 PM

|

#1082 | | My homepage has been set to RS

Join Date: Jun 2008 Location: Nowhere

Posts: 2,294

Thanked 848 Times in 392 Posts

Failed 59 Times in 28 Posts

|

A friend's parents house was bought by a development, roughly 30 - 40% ? premium in Van.

This is getting retarded.

|

|  |  09-10-2013, 03:49 PM

09-10-2013, 03:49 PM

|

#1083 | | I Will not Admit my Addiction to RS

Join Date: Feb 2013 Location: Shaughnessy

Posts: 564

Thanked 755 Times in 209 Posts

Failed 1,752 Times in 224 Posts

|

there is no bubble in housing market here. get over it already

Last edited by Gululu; 09-10-2013 at 04:06 PM.

|

|  |  09-10-2013, 05:36 PM

09-10-2013, 05:36 PM

|

#1084 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

| Quote:

Originally Posted by Gululu  there is no bubble in housing market here. get over it already | What a great use of ur time, to make a statement with absolutely no back up or even an attempt at an arguement.

Are you somehow employed in real estate? They all seem to have this same disillusioned view... Fundamentals don't matter, all other markets that went as we've gone may have fallen back in line with fundamentals, but we will stay elevated forever...

It's a joke

|

|  |  09-10-2013, 05:37 PM

09-10-2013, 05:37 PM

|

#1085 | | Proud to be called a RS Regular!

Join Date: Aug 2013 Location: Burnaby

Posts: 127

Thanked 73 Times in 30 Posts

Failed 2 Times in 1 Post

|

In my teenage years, I used to think I'd settle down in Van, buy a house and raise a family

After going through this thread, that dream is now out the window

(Before you give me an avalanche of fails, I was young and idealistic)

|

|  |  09-10-2013, 05:54 PM

09-10-2013, 05:54 PM

|

#1086 | | I *heart* Revscene.net very Muchie

Join Date: Apr 2001 Location: Van, BC

Posts: 3,666

Thanked 728 Times in 435 Posts

Failed 33 Times in 19 Posts

|

Why would you get failed? You understand the realities of the finances, and you don't feel entitled to be able to buy a house in Vancouver and raise a family here.

|

|  |  09-10-2013, 06:00 PM

09-10-2013, 06:00 PM

|

#1087 | | resident Oil Guru

Join Date: Mar 2005 Location: Vancouver

Posts: 7,716

Thanked 10,457 Times in 1,794 Posts

Failed 1,065 Times in 267 Posts

| Quote:

Originally Posted by Gululu  there is no bubble in housing market here. get over it already |  |

|  |  09-10-2013, 06:07 PM

09-10-2013, 06:07 PM

|

#1088 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

| Quote:

Originally Posted by TatsuyaKataoka  In my teenage years, I used to think I'd settle down in Van, buy a house and raise a family

After going through this thread, that dream is now out the window

(Before you give me an avalanche of fails, I was young and idealistic) | In 2000 or so, you could buy a nice place for $200-300k, salaries were in line with what they are now, in real terms, so your dream was normal.

What we're currently in is a short term anomaly due to cheap and easy money, just like the US circa 2005 - it takes a while to unwind, but unwind it will

|

|  |  09-10-2013, 06:11 PM

09-10-2013, 06:11 PM

|

#1089 | | resident Oil Guru

Join Date: Mar 2005 Location: Vancouver

Posts: 7,716

Thanked 10,457 Times in 1,794 Posts

Failed 1,065 Times in 267 Posts

| Quote:

Originally Posted by 4444  In 2000 or so, you could buy a nice place for $200-300k, salaries were in line with what they are now, in real terms, so your dream was normal.

What we're currently in is a short term anomaly due to cheap and easy money, just like the US circa 2005 - it takes a while to unwind, but unwind it will | Exactly.  |

|  |  09-10-2013, 08:11 PM

09-10-2013, 08:11 PM

|

#1090 | | Banned By Establishment

Join Date: Jan 2003 Location: Coquitlam, BC

Posts: 9,521

Thanked 1,289 Times in 409 Posts

Failed 407 Times in 100 Posts

|

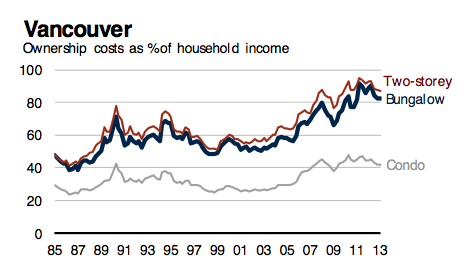

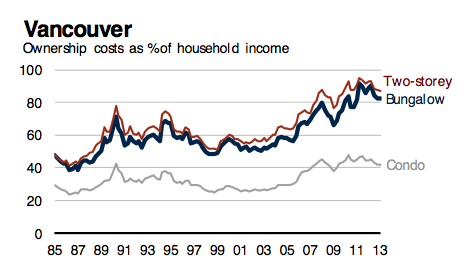

LOL, almost 100% of your income for a house. What the fuck. No bubble, yeah. Right.

|

|  |  09-10-2013, 09:18 PM

09-10-2013, 09:18 PM

|

#1091 | | Banned By Establishment

Join Date: Dec 2003 Location: New West

Posts: 3,998

Thanked 2,982 Times in 1,135 Posts

Failed 284 Times in 109 Posts

| |

|  |  09-10-2013, 09:46 PM

09-10-2013, 09:46 PM

|

#1092 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

|

A watched pot never boils. Too many housing bears watching for a major correction therefore it probably will not happen. For housing to have a significant correction in Vancouver and rest of Canada, interest rates needs to go up a lot more than where it is today. Rate were 5+% back in 2007. So 3% on the US 10-yr today is still pretty low by that measure. You also have to believe Canada is going into an economic contraction of some sort which is not likely in the next year or two.

That is not say it's all clear and buy a house. Each person has their own needs and preferences. I am renting because I just don't see any value in Vancouver properties compare to properties in California. The house I am renting (which the owner tried to sell) has a staggering price to rent ratio of 70. The return he is getting from my rent before tax doesn't even keep up with inflation. But if you are wishing for a blood bath (30-40% price correction) like what happened in US then you are probably dreaming.

|

|  |  09-10-2013, 10:17 PM

09-10-2013, 10:17 PM

|

#1093 | | resident Oil Guru

Join Date: Mar 2005 Location: Vancouver

Posts: 7,716

Thanked 10,457 Times in 1,794 Posts

Failed 1,065 Times in 267 Posts

| Quote:

Originally Posted by Carl Johnson  A watched pot never boils. Too many housing bears watching for a major correction therefore it probably will not happen. For housing to have a significant correction in Vancouver and rest of Canada, interest rates needs to go up a lot more than where it is today. Rate were 5+% back in 2007. So 3% on the US 10-yr today is still pretty low by that measure. You also have to believe Canada is going into an economic contraction of some sort which is not likely in the next year or two.

That is not say it's all clear and buy a house. Each person has their own needs and preferences. I am renting because I just don't see any value in Vancouver properties compare to properties in California. The house I am renting (which the owner tried to sell) has a staggering price to rent ratio of 70. The return he is getting from my rent before tax doesn't even keep up with inflation. But if you are wishing for a blood bath (30-40% price correction) like what happened in US then you are probably dreaming. | That's what they said in Ireland, and what they are currently saying in the Netherlands. http://www.bbc.co.uk/news/business-23681604

All bubbles, while there are variations, are pretty much the same.

|

|  |  09-11-2013, 07:45 AM

09-11-2013, 07:45 AM

|

#1094 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

|

What I am saying is that there is just no catalyst on the horizon for a major correction in Vancouver. Can we have a normal 15-20% correction to scare off some people late to the party? Oh yeah. But conditions like recession and restrictive monetary policy are just not place for a huge correction.

|

|  |  09-11-2013, 07:46 AM

09-11-2013, 07:46 AM

|

#1095 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

| Quote:

Originally Posted by Carl Johnson  A watched pot never boils. Too many housing bears watching for a major correction therefore it probably will not happen. For housing to have a significant correction in Vancouver and rest of Canada, interest rates needs to go up a lot more than where it is today. Rate were 5+% back in 2007. So 3% on the US 10-yr today is still pretty low by that measure. You also have to believe Canada is going into an economic contraction of some sort which is not likely in the next year or two.

That is not say it's all clear and buy a house. Each person has their own needs and preferences. I am renting because I just don't see any value in Vancouver properties compare to properties in California. The house I am renting (which the owner tried to sell) has a staggering price to rent ratio of 70. The return he is getting from my rent before tax doesn't even keep up with inflation. But if you are wishing for a blood bath (30-40% price correction) like what happened in US then you are probably dreaming. | You totally contradict urself here, price to rent of 70, guy can't sell - no bubble?

As for Canada's economy... I'm not so sure about this one, real estate makes up way too much of our economy, and it really shouldn't

It will go back to long term, inflation adjusted norms, whether today, 1 year from now, or 5 years from now, it will happen, that's why they call it the 'norm' or long term average (and no, we're not into some new kind of new higher average)

Fundamentals rule, it's why Tesla's stock will come down, not today, as it has too much momentum, but it will come back down to good growth company fundamentals - vancouver and the rest of Canada's real estate is like a momentum stock, just on a way bigger scale

|

|  |  09-11-2013, 07:50 AM

09-11-2013, 07:50 AM

|

#1096 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

| Quote:

Originally Posted by Carl Johnson  What I am saying is that there is just no catalyst on the horizon for a major correction in Vancouver. Can we have a normal 15-20% correction to scare off some people late to the party? Oh yeah. But conditions like recession and restrictive monetary policy are just not place for a huge correction. | A 15-20% correction would lead to a much bigger decrease.

That much correction would wipe out billions of dollars of equity, all those monkies that bought with <20% down would now be underwater, thus are immobile, can't upgrade, can't do anything, they'll likely not be able to renew their mortgage, as they won't meet the equity standards.

It's like a house of cards, this 15-20% fall would be the beginning, not the end

It's not just about monthly payment. The inability to remortgage is huge, and that's why the major correction won't be until 2-3 years away, when a lot of horny 5% down money will be looking to renew their 5 year 2.89% mortgage, except on a smaller equity base, and with a mortgage at nearer 4% - whoops, that just won't happen, as real incomes aren't increasing any, especially in Vancouver...

|

|  |  09-11-2013, 07:52 AM

09-11-2013, 07:52 AM

|

#1097 | | My dinner reheated before my turbo spooled

Join Date: Oct 2002 Location: vancouver

Posts: 1,766

Thanked 640 Times in 242 Posts

Failed 12 Times in 9 Posts

|

^ So we can finally say you are right in 2-3 years?

|

|  |  09-11-2013, 08:03 AM

09-11-2013, 08:03 AM

|

#1098 | | I contribute to threads in the offtopic forum

Join Date: Jun 2006 Location: not vancouver

Posts: 2,642

Thanked 1,941 Times in 765 Posts

Failed 532 Times in 202 Posts

| Quote:

Originally Posted by VR6GTI  ^ So we can finally say you are right in 2-3 years? | You can do whatever the hell you want - I don't care about being right or wrong for this crowd, although many appreciate my knowledgeable viewpoint on the subject.

I'm right because I don't have money in cdn real estate, but have US real estate worth tonnes more than when I bought it, plus the rental yield... I'm just looking for a return to fundamentals so I can invest in my local market... Until that happens, I'll sit on the sideline and when ppl ask for my advice, I'll give it, or when ppl say things that are blatantly one sided, I will provide a counter point based on science, not emotion (fundamentals are science, as all things come back to fundamentals)

|

|  |  09-11-2013, 08:12 AM

09-11-2013, 08:12 AM

|

#1099 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

| Quote:

Originally Posted by 4444  A 15-20% correction would lead to a much bigger decrease.

That much correction would wipe out billions of dollars of equity, all those monkies that bought with <20% down would now be underwater, thus are immobile, can't upgrade, can't do anything, they'll likely not be able to renew their mortgage, as they won't meet the equity standards.

It's like a house of cards, this 15-20% fall would be the beginning, not the end

It's not just about monthly payment. The inability to remortgage is huge, and that's why the major correction won't be until 2-3 years away, when a lot of horny 5% down money will be looking to renew their 5 year 2.89% mortgage, except on a smaller equity base, and with a mortgage at nearer 4% - whoops, that just won't happen, as real incomes aren't increasing any, especially in Vancouver... | Obviously we are gonna find out who is swimming naked all this time when the tide goes out. I have to admit some people are way over their head about real estate here. They think Burnaby is Beverley Hill with new houses listed for $2.5 million which works out to be $650+ per square feet. At that valuation you can get into premium area like San Marino in Cal.

|

|  |  09-11-2013, 08:12 AM

09-11-2013, 08:12 AM

|

#1100 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2001

Posts: 5,086

Thanked 2,619 Times in 1,183 Posts

Failed 81 Times in 54 Posts

|

But, what if the fundamentals are wrong themselves? (I.e. Average household incomes)

Money under the table, money from overseas (which skewers the income average), income that is shielded through sole proprietorships (Vancouver has the highest concentration of these), etc?

Posted via RS Mobile |

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 06:16 PM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!