| Vancouver Off-Topic / Current Events The off-topic forum for Vancouver, funnies, non-auto centered discussions, WORK SAFE. While the rules are more relaxed here, there are still rules. Please refer to sticky thread in this forum. |

| |  04-12-2022, 07:41 PM

04-12-2022, 07:41 PM

|

#21451 | | RS has made me the bitter person i am today!

Join Date: Mar 2006 Location: Vancouver

Posts: 4,786

Thanked 3,503 Times in 1,634 Posts

Failed 63 Times in 38 Posts

| Quote:

Originally Posted by Gerbs  If RE drops 75%, I think a majority of us can cash buy a house, I think a majority of people can do that even if it dropped 40%  | If RE drops 75% in Vancouver I think most of us would probably consider not living here or can no longer live here.

|

|  |  04-12-2022, 07:42 PM

04-12-2022, 07:42 PM

|

#21452 | | To me, there is the Internet and there is RS

Join Date: Apr 2007 Location: Okanagan

Posts: 17,102

Thanked 9,852 Times in 4,295 Posts

Failed 432 Times in 230 Posts

|

I've been hearing about a supposed pending crash in BC since I was a kid. That was long enough ago that you could've paid off a mortgage by now lol.

__________________ 1991 Toyota Celica GTFour RC // 2007 Toyota Rav4 V6 // 2000 Jeep Grand Cherokee

1992 Toyota Celica GT-S ["sold"] \\ 2007 Jeep Grand Cherokee CRD [sold] \\ 2000 Jeep Cherokee [sold] \\ 1997 Honda Prelude [sold] \\ 1992 Jeep YJ [sold/crashed] \\ 1987 Mazda RX-7 [sold] \\ 1987 Toyota Celica GT-S [crushed] Quote:

Originally Posted by maksimizer  half those dudes are hotter than ,my GF. | Quote:

Originally Posted by RevYouUp  reading this thread is like waiting for goku to charge up a spirit bomb in dragon ball z | Quote:

Originally Posted by Good_KarMa  OH thank god. I thought u had sex with my wife. :cry: | |

|  |  04-12-2022, 09:55 PM

04-12-2022, 09:55 PM

|

#21453 | | Need to Seek Professional Help

Join Date: Jan 2005 Location: Van

Posts: 1,063

Thanked 548 Times in 293 Posts

Failed 27 Times in 15 Posts

| Quote:

Originally Posted by SumAznGuy  No man, go back to page one of this thread.

People been predicting a market crash for a long time.

*Edit this thread started in 2012 but there was another one that had the same predictions back in 2008. | There's a similar thread on Red flag deals that started in 2012 too, and it has pricing going back to 2002.

|

|  |  04-12-2022, 09:56 PM

04-12-2022, 09:56 PM

|

#21454 | | Need to Seek Professional Help

Join Date: Jan 2005 Location: Van

Posts: 1,063

Thanked 548 Times in 293 Posts

Failed 27 Times in 15 Posts

| Quote:

Originally Posted by Gerbs  If RE drops 75%, I think a majority of us can cash buy a house, I think a majority of people can do that even if it dropped 40%  | If it drops 75% and Vancouver is still as beautiful as it is today, people on revscene will be fighting each other to buy up entire blocks lol.

|

|  |  04-12-2022, 10:27 PM

04-12-2022, 10:27 PM

|

#21455 | | Rs has made me the man i am today!

Join Date: Sep 2004 Location: Canada

Posts: 3,026

Thanked 1,375 Times in 575 Posts

Failed 28 Times in 12 Posts

|

^buying the entire block is the only way to get away from pie plates.

|

|  |  04-13-2022, 06:13 AM

04-13-2022, 06:13 AM

|

#21456 | | I *heart* Revscene.net very Muchie

Join Date: Mar 2011 Location: Vancouver

Posts: 3,660

Thanked 3,917 Times in 1,593 Posts

Failed 81 Times in 39 Posts

| https://twitter.com/bankofcanada/sta...ei_SW3CUejKUFg

Bank of Canada raises rates by 50bps from .5% to 1%. Maybe instead of 6-8 increases we see 3 big ass ones instead.

__________________

Current: 2019 Acura RDX

Gone: 2007 Acura TSX, 2008 Mazda 3 GT, 2003 Mazda Miata LS, 2008 Mazda Miata GT PRHT, 2003 Mazda Protege 5

|

|  |  04-13-2022, 06:36 AM

04-13-2022, 06:36 AM

|

#21457 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 8,649

Thanked 4,845 Times in 2,331 Posts

Failed 303 Times in 146 Posts

|

^ kind a funny that people are all tied up in knots that interest rate is 1%. I remember my parents paying like 12-15% interest/mortgage rate ... and they still bought a house ... haha.

|

|  |  04-13-2022, 07:09 AM

04-13-2022, 07:09 AM

|

#21458 | | I told him no, what y'all do?

Join Date: Aug 2006 Location: Vancouver

Posts: 10,304

Thanked 6,110 Times in 2,669 Posts

Failed 106 Times in 68 Posts

|

they also bought a house for under $200k

__________________ Feedback

http://www.revscene.net/forums/showthread.php?t=611711 Quote: Greenstoner

1 rat shit ruins the whole congee

originalhypa

You cannot live the life of a whore and expect a monument to your chastity | Quote:

[22-12, 08:51]mellomandidnt think and went in straight..scrapped like a bitch

[17-09, 12:07]FastAnna glowjob

[17-09, 12:08]FastAnna I like dat

| |

|  |  04-13-2022, 07:33 AM

04-13-2022, 07:33 AM

|

#21459 | | Fathered more RS members than anybody else. Who's your daddy?

Join Date: Aug 2002

Posts: 25,114

Thanked 11,774 Times in 5,044 Posts

Failed 316 Times in 202 Posts

| Quote:

Originally Posted by whitev70r  ^ kind a funny that people are all tied up in knots that interest rate is 1%. I remember my parents paying like 12-15% interest/mortgage rate ... and they still bought a house ... haha. | I survived 18% in the early 80's. Had no choice. Timing was bad.

Houses wer under 200k, but wages were like shit............ barely qualified for a mortgage.

__________________ Quote: |

"there but for the grace of god go I"

| Quote: |

Youth is, indeed, wasted on the young.

| YODO = You Only Die Once.

Dirty look from MG1 can melt steel beams.

"There must be dissonance before resolution - MG1" a musical reference.

|

|  |  04-13-2022, 07:38 AM

04-13-2022, 07:38 AM

|

#21460 | | Willing to sell body for a few minutes on RS

Join Date: Jul 2001 Location: Cloverdale

Posts: 11,604

Thanked 3,843 Times in 1,361 Posts

Failed 83 Times in 42 Posts

| Quote:

Originally Posted by MG1  I survived 18% in the early 80's. Had no choice. Timing was bad.

Houses wer under 200k, but wages were like shit............ barely qualified for a mortgage. | What percentage of people do you think 18% would bankrupt today considering homes and most mortgages are probably 7-10x what they were in the 80s? I don't even have a big mortgage relatively speaking compared to some people but it would probably do me in.

__________________

“The world ain't all sunshine and rainbows. It's a very mean and nasty place... and I don´t care how tough you are, it will beat you to your knees and keep you there permanently, if you let it. You, me or nobody, is gonna hit as hard as life. But ain't about how hard you hit... It's about how hard you can get hit, and keep moving forward... how much you can take, and keep moving forward. That´s how winning is done. Now, if you know what you worth, go out and get what you worth.” - Rocky Balboa |

|  |  04-13-2022, 07:51 AM

04-13-2022, 07:51 AM

|

#21461 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Feb 2002 Location: Vancouver

Posts: 8,372

Thanked 4,001 Times in 1,545 Posts

Failed 35 Times in 27 Posts

| Quote:

Originally Posted by MG1  Houses wer under 200k, but wages were like shit............ barely qualified for a mortgage. | Is that any different today? Were rental suites required to qualify? And this is at 1% interest….

__________________

Crush - 1971 Datsun 240z - Build Thread

The Daily - Rav4 V6 - “Goldilocks”

|

|  |  04-13-2022, 08:19 AM

04-13-2022, 08:19 AM

|

#21462 | | RS controls my life!

Join Date: Mar 2012

Posts: 768

Thanked 562 Times in 245 Posts

Failed 62 Times in 18 Posts

|

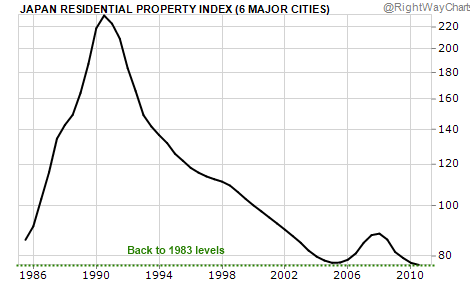

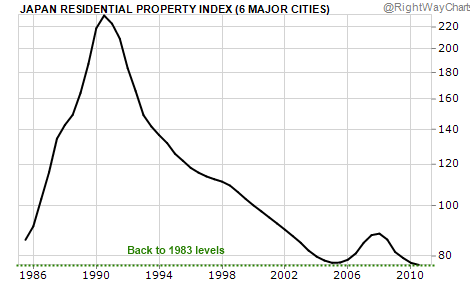

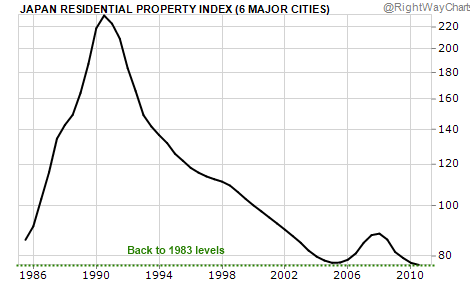

For those laughing at the bears, just because the risk hasn't materialized, it doesn't mean the risk wasn't there. That is a classical logical fallacy in risk management. If you guys don't think its possible for RE here to experience a sustained decline, look no further than what happened to Japan a couple of decades ago.

At least Japan had a robust economy at that time; At the bubble's peak in the early 1990's, Japan was the 2nd largest economy in the world behind US (US GDP of 5.7 trillion vs JP GDP of 3.1 trillion USD). Last time I checked, Van's economy is... not that special to say the least? When the bubble popped, property prices in JP declined as much as 60% spanning over two decades. If you study markets long enough, you will realize that markets are always cyclic in nature because that's how humans fundamentally behave at a macro level. You can go back thousands of years dating back to the Romans and observe market cycles. Trying to time the peak and trough is a fool's errand but markets will eventually mean-revert back to its fundamentals. With the recent deployment of Modern Monetary Theory (extremely low interest rates under Quantitative Easing etc.), central bankers have managed to stretch out the market cycles but I doubt that we have eliminated recessions all together from our economy.

Another fun comparison: Since 2010, S&P500 has return ~3x and Nasdaq100 has returned ~7x. If I had 1M invested between these two indices in 2010, I'd be somewhere between 3~7M right now even without any additional investments during that period. Doesn't sound like a very bad deal considering I would have slept sound at night knowing that my wealth is well diversified across the world's largest companies as opposed to largely dependent on a single residential property? Before you compare it against some anecdotal RE gains, you should only be comparing unlevered returns since leverage (i.e. taking on debt and thereby increasing risk) is a separate investment decision altogether.

|

|  |  04-13-2022, 08:43 AM

04-13-2022, 08:43 AM

|

#21463 | | Willing to sell body for a few minutes on RS

Join Date: Mar 2002 Location: Victoria

Posts: 10,663

Thanked 5,154 Times in 1,901 Posts

Failed 185 Times in 100 Posts

|

I think very few of those "housing bears" are not fiscally wise enough that they are making those proper investments to realise the gains you speak. How many people had a million bucks in 2010 to invest? But a half million dollar mortgage was very obtainable.

While your points make sense if you're using secondary properties as an investment vehicle. It's much more difficult and complex when you're talking about your actual home you need to live in.

I don't know about you, but I sleep better at night knowing that I don't have to worry about a landlord deciding to sell my home from under me and throwing my life into stress and turmoil.

You can't live inside those diversified investments for 25 years. If that means I'll have a bit less overall wealth at the end of it, oh well.

__________________

1968 Mustang Coupe

2008.5 Mazdaspeed 3

1997 GMC Sonoma ZR2

2014 F150 5.0L XTR 4x4

A vehicle for all occasions

Last edited by Great68; 04-13-2022 at 09:09 AM.

|

|  |  04-13-2022, 09:36 AM

04-13-2022, 09:36 AM

|

#21464 | | RS controls my life!

Join Date: Mar 2012

Posts: 768

Thanked 562 Times in 245 Posts

Failed 62 Times in 18 Posts

| Quote:

Originally Posted by Great68  It's much more difficult and complex when you're talking about your actual home you need to live in. | Agree 100%, buying a property to live in is more than a pure investment decision. My post was more poking fun at the crowd who seem to think that our RE market here is somehow immune to the tides of broader market cycles. I bet during the 80's people in JP were making the type of comments about how their city/country is so special that the their RE gravy train is going to last forever. Quote:

Originally Posted by Great68  I don't know about you, but I sleep better at night knowing that I don't have to worry about a landlord deciding to sell my home from under me and throwing my life into stress and turmoil. | If someone bought their place a really long time ago when prices were reasonable, then sure, they're just playing with house money at this point so why wouldn't they sleep well at night. Could we say the same thing about someone who have recently invested their entire net worth as down payment for a condo in Brentwood at ~1,200/sqft (i.e. abysmal cap rate)? My point is, sitting on the sidelines, when the risk/reward ratio seems utterly skewed, is a reasonable choice for some people.

|

|  |  04-13-2022, 09:39 AM

04-13-2022, 09:39 AM

|

#21465 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2014 Location: Van

Posts: 5,396

Thanked 2,239 Times in 1,202 Posts

Failed 227 Times in 136 Posts

|

Finally car prices will drop?  |

|  |  04-13-2022, 09:56 AM

04-13-2022, 09:56 AM

|

#21466 | | RS has made me the bitter person i am today!

Join Date: Mar 2006 Location: Vancouver

Posts: 4,786

Thanked 3,503 Times in 1,634 Posts

Failed 63 Times in 38 Posts

| Quote:

Originally Posted by GGnoRE  For those laughing at the bears, just because the risk hasn't materialized, it doesn't mean the risk wasn't there. That is a classical logical fallacy in risk management. If you guys don't think its possible for RE here to experience a sustained decline, look no further than what happened to Japan a couple of decades ago.

At least Japan had a robust economy at that time; At the bubble's peak in the early 1990's, Japan was the 2nd largest economy in the world behind US (US GDP of 5.7 trillion vs JP GDP of 3.1 trillion USD). Last time I checked, Van's economy is... not that special to say the least? When the bubble popped, property prices in JP declined as much as 60% spanning over two decades. If you study markets long enough, you will realize that markets are always cyclic in nature because that's how humans fundamentally behave at a macro level. You can go back thousands of years dating back to the Romans and observe market cycles. Trying to time the peak and trough is a fool's errand but markets will eventually mean-revert back to its fundamentals. With the recent deployment of Modern Monetary Theory (extremely low interest rates under Quantitative Easing etc.), central bankers have managed to stretch out the market cycles but I doubt that we have eliminated recessions all together from our economy.

Another fun comparison: Since 2010, S&P500 has return ~3x and Nasdaq100 has returned ~7x. If I had 1M invested between these two indices in 2010, I'd be somewhere between 3~7M right now even without any additional investments during that period. Doesn't sound like a very bad deal considering I would have slept sound at night knowing that my wealth is well diversified across the world's largest companies as opposed to largely dependent on a single residential property? Before you compare it against some anecdotal RE gains, you should only be comparing unlevered returns since leverage (i.e. taking on debt and thereby increasing risk) is a separate investment decision altogether. | Japan is a very special case and takes a certain set of circumstances for that to happen. Canada in particular is very welcoming of immigrants (our whole doctrine is based around immigration) whereas it's extremely hard to get Japanese citizenship which limits external factors that would help against that fall.

Even in Japan, their initial drop was 35% over 3 years, yeah that's gonna hurt for Vancouver too, but most people that bought in even a year ago are pretty much priced in against a 20% drop so in reality the exposure for SFH isn't that large. SFH also has the benefit of being a scarce commodity now. Now if you bought a 500sqft 1bd at $500k it's going to suck if you are fully stretched out.

After the initial falling, 25% over 15 years is really small imo, and it's unlikely Vancouver would be falling for that long save for some catastrophic event.

|

|  |  04-13-2022, 09:59 AM

04-13-2022, 09:59 AM

|

#21467 | | Willing to sell a family member for a few minutes on RS

Join Date: Apr 2011 Location: North vancouver

Posts: 13,318

Thanked 33,732 Times in 7,966 Posts

Failed 227 Times in 175 Posts

| Quote:

Originally Posted by whitev70r  ^ kind a funny that people are all tied up in knots that interest rate is 1%. I remember my parents paying like 12-15% interest/mortgage rate ... and they still bought a house ... haha. | A house in Vancouver back then was about 5x the median family income. Now it’s about 30x.

It’s pretty reasonable to carry a 100k mortgage at 18% compared to a 1.5million dollar mortgage at 2% with only 1.8x the salary. Not to mention the 500k for a down payment as opposed to 50-100k if you go ham on savings for 5 years. It’s completely incomparable.

I get it, not everyone needs a house with a yard, priorities and expectations have changed. But the condos we are living in, with the jobs many of us have we could have bought cash by the time we were able to buy nowadays, if we time machined back.

__________________

98 technoviolet M3/2/5 Quote:

Originally Posted by boostfever  Westopher is correct. | Quote:

Originally Posted by fsy82  seems like you got a dick up your ass well..get that checked | Quote:

Originally Posted by punkwax  Well.. I’d hate to be the first to say it, but Westopher is correct. | |

|  |  04-13-2022, 11:37 AM

04-13-2022, 11:37 AM

|

#21468 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2001

Posts: 5,087

Thanked 2,619 Times in 1,183 Posts

Failed 81 Times in 54 Posts

| |

|  |  04-13-2022, 11:42 AM

04-13-2022, 11:42 AM

|

#21469 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Nov 2002 Location: 604

Posts: 8,649

Thanked 4,845 Times in 2,331 Posts

Failed 303 Times in 146 Posts

|

I think salaries back then was about $20K-$25K/yr ... avg so if house is $200-$250K, it's still 10x of annual income.

Let's say avg income is $100K (according to PB's income level chart), you can get a townhouse for $1.5M so maybe 15x annual income.

Discrepancy is there but not as much as some of you make it out to be, to compensate for like a 12-15% interest rate differential. Anyhow, not to debate this to death. No matter how you look at it, 1% interest to borrow like a million dollars is a pretty damn good deal.

|

|  |  04-13-2022, 11:58 AM

04-13-2022, 11:58 AM

|

#21470 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 38,684

Thanked 15,551 Times in 6,293 Posts

Failed 2,132 Times in 726 Posts

| Quote:

Originally Posted by Tapioca  | You’ll never fix housing without either A) making all existing home owners substantially wealthier through rezoning etc.

Or B) decimating those same peoples paper gains/retirement at the cost of some sort of welfare state housing for all initiative.

I feel like option A looks better to most govts. And likely is less strenuous on the system as a whole than option B

__________________

Dank memes cant melt steel beams

|

|  |  04-13-2022, 12:47 PM

04-13-2022, 12:47 PM

|

#21471 | | Willing to sell a family member for a few minutes on RS

Join Date: Apr 2011 Location: North vancouver

Posts: 13,318

Thanked 33,732 Times in 7,966 Posts

Failed 227 Times in 175 Posts

|

In 1990 the median household income in Canada was 56k, today it’s 80k. The numbers dictate the math I posted.

The average DETACHED home price in van in 1993 was 330k, adjusted for todays dollars that’s around 550k

__________________

98 technoviolet M3/2/5 Quote:

Originally Posted by boostfever  Westopher is correct. | Quote:

Originally Posted by fsy82  seems like you got a dick up your ass well..get that checked | Quote:

Originally Posted by punkwax  Well.. I’d hate to be the first to say it, but Westopher is correct. | |

|  |  04-13-2022, 01:32 PM

04-13-2022, 01:32 PM

|

#21472 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 38,684

Thanked 15,551 Times in 6,293 Posts

Failed 2,132 Times in 726 Posts

|

We have quite a few friends who’s parents live in North Van etc. nice areas nice homes where the Dad was a mechanic and the mom was stay at home. Or the Dad was an architect and the mom had like a little side hustle

Now in both those scenarios you couldn’t afford to buy in Chilliwack

__________________

Dank memes cant melt steel beams

|

|  |  04-13-2022, 03:30 PM

04-13-2022, 03:30 PM

|

#21473 | | I *heart* Revscene.net very Muchie

Join Date: Mar 2011 Location: Vancouver

Posts: 3,660

Thanked 3,917 Times in 1,593 Posts

Failed 81 Times in 39 Posts

| Quote:

Originally Posted by Hondaracer  We have quite a few friends who’s parents live in North Van etc. nice areas nice homes where the Dad was a mechanic and the mom was stay at home. Or the Dad was an architect and the mom had like a little side hustle

Now in both those scenarios you couldn’t afford to buy in Chilliwack  | But they didn't have the temptation of avocado toast or Starbucks lattes back then. If they did they'd still be renters. /s

__________________

Current: 2019 Acura RDX

Gone: 2007 Acura TSX, 2008 Mazda 3 GT, 2003 Mazda Miata LS, 2008 Mazda Miata GT PRHT, 2003 Mazda Protege 5

|

|  |  04-13-2022, 04:03 PM

04-13-2022, 04:03 PM

|

#21474 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,038

Thanked 2,758 Times in 1,070 Posts

Failed 256 Times in 73 Posts

| Quote:

Originally Posted by GLOW  they also bought a house for under $200k | Will cash buy a house if it's 12 - 15% interest rate even at $400k

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

|

|  |  04-13-2022, 04:09 PM

04-13-2022, 04:09 PM

|

#21475 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2001

Posts: 5,087

Thanked 2,619 Times in 1,183 Posts

Failed 81 Times in 54 Posts

|

I despise the boomer memes about avocado toast and lattes, but there's a kernel of truth to how certain things have become entitlements over the last decade or so.

I don't think I would be surprised to see $1000/month spent on take out and restaurant meals among the undisciplined. Think about the growth in certain services over the past several years - fitness/wellness studios, spas, events, etc. And if you're not travelling at least twice a year on an airplane (pre-COVID), you're not keeping up with your peers.

|

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 03:21 PM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!