| Vancouver Off-Topic / Current Events The off-topic forum for Vancouver, funnies, non-auto centered discussions, WORK SAFE. While the rules are more relaxed here, there are still rules. Please refer to sticky thread in this forum. |

| |  12-18-2014, 09:19 AM

12-18-2014, 09:19 AM

|

#76 | | HELP ME PLS!!!

Join Date: May 2002 Location: vancity

Posts: 5,734

Thanked 722 Times in 364 Posts

Failed 40 Times in 26 Posts

|

Correc me if I'm wrong. It's the Saudis and US creating the dip in oil prices?

|

|  |  12-18-2014, 10:29 AM

12-18-2014, 10:29 AM

|

#77 | | RS.net, where our google ads make absolutely no sense!

Join Date: May 2007 Location: Surrey

Posts: 957

Thanked 272 Times in 69 Posts

Failed 5 Times in 3 Posts

|

It's apparently $66/barrel right now, lots of contractors getting laid off here at CNRL. It'll definitely be cheaper next year.

__________________

1989 240sx Quote:

Originally Posted by Presto  I went to Saskatchewan once. 30min is all I need to know that I don't want to go back there. | |

|  |  12-18-2014, 11:46 AM

12-18-2014, 11:46 AM

|

#78 | | reads most threads with his pants around his ankles, especially in the Forced Induction forum.

Join Date: Mar 2004 Location: Vancouver

Posts: 10,645

Thanked 2,191 Times in 1,131 Posts

Failed 929 Times in 340 Posts

| Quote:

Originally Posted by godwin  It is more like Saudi wants to pressure Iran and Qatar to fold.. and also make sure the tarsands and North Dakota crude is not economically viable (might not be a bad thing for us, at least it will get the environmentalists off our backs for a while).

Russia is just a side show. It is not even OPEC.

Either way, Russia is and will be the only economical LNG supplier to Europe (a lot of fracking projects in Europe turn up bubkuss) .. Europe right now just wants a regime change, because they know Russia holds them by the balls. | Russian ruble firms sharply as government pressures exporters | Reuters

hard to say what will happen next. But from what I read it seems Ruble have fallen over 50% since the beginning of this year?

|

|  |  12-18-2014, 12:21 PM

12-18-2014, 12:21 PM

|

#79 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Aug 2007 Location: Paradise, BC

Posts: 8,077

Thanked 7,868 Times in 3,246 Posts

Failed 259 Times in 145 Posts

|

If oil prices remain low, and Russia continues to try and back the Ruble without making huge concessions on Ukraine, they are not going to last long. They will run out of foreign reserves, and then the Russian national finance system as well as their economy will collapse. Along with it, the Russian state will probably face a huge risk of collapsing as well.

Naturally, the smartest thing Putin could do is to pull out of Ukraine, and tell the Russian government to do nothing and just let the Ruble depreciate. Yes, the Ruble will be hit hard, and Russia will face a harsh recession for a few years. But at least they can preserve their foreign reserves for things and situations that are really necessary, and a low Ruble along with assistance from RoW could help their non-oil-related export sector rebound.

Given Putin's nature and ego, however, I totally doubt he will go along with the above plan at this point. This tyrant values his face and ego more than a lot of other things.

|

|  |  01-05-2015, 09:36 AM

01-05-2015, 09:36 AM

|

#80 | | Proud to be called a RS Regular!

Join Date: Oct 2014 Location: Kits

Posts: 119

Thanked 225 Times in 52 Posts

Failed 282 Times in 29 Posts

| |

|  |  01-05-2015, 10:11 AM

01-05-2015, 10:11 AM

|

#81 | | Banned (ABWS)

Join Date: Sep 2013 Location: Vancouver

Posts: 2,452

Thanked 2,667 Times in 960 Posts

Failed 1,536 Times in 385 Posts

|

Hope that loonie drops like a rock!!!

|

|  |  01-05-2015, 10:34 AM

01-05-2015, 10:34 AM

|

#82 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 39,479

Thanked 16,089 Times in 6,561 Posts

Failed 2,165 Times in 747 Posts

|

Bitcoin sure took a nose dive with the rubel drop

__________________

Dank memes cant melt steel beams

|

|  |  01-05-2015, 11:07 AM

01-05-2015, 11:07 AM

|

#83 | | RS has made me the bitter person i am today!

Join Date: Feb 2013 Location: Vancouver

Posts: 4,891

Thanked 7,790 Times in 2,326 Posts

Failed 409 Times in 181 Posts

| Quote:

Originally Posted by multicartual  Hope that loonie drops like a rock!!! | Are you perhaps making a foray into a field which exports...organic...matter to the US?  |

|  |  01-05-2015, 11:09 AM

01-05-2015, 11:09 AM

|

#84 | | Banned (ABWS)

Join Date: Sep 2013 Location: Vancouver

Posts: 2,452

Thanked 2,667 Times in 960 Posts

Failed 1,536 Times in 385 Posts

| Quote:

Originally Posted by meme405  Are you perhaps making a foray into a field which exports...organic...matter to the US?  |

I would never get involved with anything illegal outside of big burnouts and backstreet hooning because my freedom is priceless

|

|  |  01-06-2015, 03:04 PM

01-06-2015, 03:04 PM

|

#85 | | OMGWTFBBQ is a common word I say everyday

Join Date: Apr 2006 Location: Tres Ciudades

Posts: 5,407

Thanked 3,680 Times in 1,522 Posts

Failed 150 Times in 53 Posts

|

holy shat...gas is 99.9 at the PoCo Costco...never thought i'd see the day gas dips under a dollar again.

|

|  |  01-06-2015, 04:56 PM

01-06-2015, 04:56 PM

|

#86 | | Willing to sell a family member for a few minutes on RS

Join Date: Feb 2005 Location: Surrey

Posts: 12,760

Thanked 689 Times in 376 Posts

Failed 61 Times in 38 Posts

|

I don't follow the markets but can someone please school me on how the canadian dollar is tied into oil prices? It seems like with the price of oil dropping so is the canadian dollar. It doesn't work the other way around when the price of oil is high, the dollar stays the same, if I recall correctly.

|

|  |  01-06-2015, 05:04 PM

01-06-2015, 05:04 PM

|

#87 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 39,479

Thanked 16,089 Times in 6,561 Posts

Failed 2,165 Times in 747 Posts

| Quote:

Originally Posted by hotjoint  I don't follow the markets but can someone please school me on how the canadian dollar is tied into oil prices? It seems like with the price of oil dropping so is the canadian dollar. It doesn't work the other way around when the price of oil is high, the dollar stays the same, if I recall correctly. | This time around it will likely be effected moreso.

Canada producing oil, canadian GDP increases, dollar rises accordingly.

BTW, filled up at 97.9 in aldergrove on the weekend.

__________________

Dank memes cant melt steel beams

|

|  |  01-06-2015, 05:14 PM

01-06-2015, 05:14 PM

|

#88 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 39,479

Thanked 16,089 Times in 6,561 Posts

Failed 2,165 Times in 747 Posts

|

edit double post

__________________

Dank memes cant melt steel beams

|

|  |  01-06-2015, 07:39 PM

01-06-2015, 07:39 PM

|

#89 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

| Quote:

Originally Posted by hotjoint  I don't follow the markets but can someone please school me on how the canadian dollar is tied into oil prices? It seems like with the price of oil dropping so is the canadian dollar. It doesn't work the other way around when the price of oil is high, the dollar stays the same, if I recall correctly. | Terence Corcoran: The end of Canada’s oil superpower pipe dreams Terence Corcoran | January 6, 2015 | Last Updated: Jan 6 9:39 PM ET More from Terence Corcoran | @terencecorcoran  AP Photo/Pablo Martinez Monsivais, FileWhen even a Republican-dominated Senate can’t muster enough support to force the Barack Obama’s hand, it’s a sure sign that activist opponents of Keystone dominate the pipeline decision-making process.

The Washington dust has not yet settled around Canada’s Keystone XL pipeline, but the fuzzy images visible Tuesday through the political storm do not look promising. Nothing in the current play of politics and oil prices would lead to the conclusion that Keystone will ever get approved. But it’s worse than that for Canada. As the world oil market swirls, not just Keystone is at stake. The greater risk is that the great national global energy superpower dream is going down the drain, washed away by a confluence of forces over which Canada has no control.

On Tuesday, the White House said President Barack Obama would veto the latest Republican effort to push a Senate Keystone bill through Congress. It was an easy decision for the President to announce, since it appears the Senate failed to come up with the necessary 67 votes to override Mr. Obama’s veto.

When even a Republican-dominated Senate can’t muster enough support to force the President’s hand, it’s a sure sign that environmentalists and other activist opponents of Keystone still dominate the pipeline decision-making process.

While Canada’s dreams of exporting more oil sands production to the United States face a grim political environment, the economic environment looks even shakier. The price of West Texas crude dropped to $47.65 during trading Tuesday, and there was no reason to believe the oil price crash is near an end. At that price, Canada’s big pipeline plans could turn to pipe dreams.

The plunge in price of oil is more than just a surprise. This is what in official economic jargon is called an economic shock. Mostly, it seems to be a supply shock — brought on in part by the surge in U.S. shale production that in turn was created by technological change that is now sweeping the world.

Back in 2011, then Natural Resources Minister Joe Oliver told Washington that if Keystone were not approved, Canada had other options to “sell the oil elsewhere.” Oil industry officials blasted America with bravado: “OK pipe or lose our oil.”

Maybe that sounded tough in November, 2011, but since then the United States has emerged as the world’s fasted growing oil producer and the world’s largest oil producer.

When Mr. Oliver made his veiled threat to sell Canadian oil elsewhere, American oil production languished at 6,000,000 barrels a day, not far off its modern-day low. Then came the American shale oil revolution (See graph). In October, 2014, U.S. oil production hit 9,000,000 barrels a day, an increase of 50% over three years and one of the major causes of the current oil price cash. The U.S. oil output boom has also blown a big hole in peak oil theory, which has long dined out on the idea that the United States was a model for the theory on the grounds that U.S. oil output had “peaked” in the 1970s. That peak may soon be surpassed.

And so now, instead of Canada selling oil elsewhere, the United States is selling its oil elsewhere. The day before New Year’s Eve, the Obama administration lifted a 40-year-old ban on oil exports that had been imposed as part of Middle East oil embargoes during the 1970s.

There’s more to the world oil price shock than U.S. shale production, and geopolitical forces — in Russia, the Middle East, China, OPEC — could shift to reverse the price trend. Some say the shale revolution will run out of steam and the price of oil will soon shoot back up. Maybe, but in the meantime Canada’s energy ambitions are in a dangerous losing position.

The promoted alternatives to Keystone, Northern Gateway to the West Coast and the much-touted Energy East line through to Quebec and New Brunswick, are almost certainly uneconomical if the price of oil were to hang in at below $50 for any extended period of time. Could Canada’s big oil sands stash become locked up in Alberta for decades? Oil prices and new technologies — not to mention new native environmental attitudes — would have to undergo dramatic change in future before the prospects for Canadian oil exports improve.

As for Keystone, the U.S. shale revolution plays right into President Obama’s new energy nationalism, even protectionism. “We don’t need your stinking Canadian oil” is close to what the President’s Keystone message has been for the past year. As he put it in November, “This is Canadian oil, this isn’t U.S. oil.” What next from Mr. Obama? These are Canadian-made automobiles, not U.S.-made automobiles?

Similar protectionist language has dominated his Keystone comments on many occasions. His administration, he says, is committed to “American-made energy that creates jobs.” Under his administration, he says, “domestic oil and gas production is up, while imports of foreign oil are down,” comments directed at Keystone. This is classic mercantilism, the national push for exports and against imports.

The Obama administration has had six years to approve Canada’s Keystone pipeline. Nothing Mr. Obama has said over that time suggests he has any interest in changing his mind. With the surge in U.S. oil production and the new oil price level providing a boost for the U.S. dollar and U.S. consumers, he can see a resurgence of the United States as a superpower. For Canada’s plans to become one, that’s bad news.

|

|  |  01-06-2015, 07:42 PM

01-06-2015, 07:42 PM

|

#90 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

|

It is not just keystone of course. The prospect for B.C. to be a major exporter of LNG is going to be a pipe-dream as well if price stay at current level for a year or two.

|

|  |  01-06-2015, 10:08 PM

01-06-2015, 10:08 PM

|

#91 | | RS has made me the bitter person i am today!

Join Date: Feb 2013 Location: Vancouver

Posts: 4,891

Thanked 7,790 Times in 2,326 Posts

Failed 409 Times in 181 Posts

| Quote:

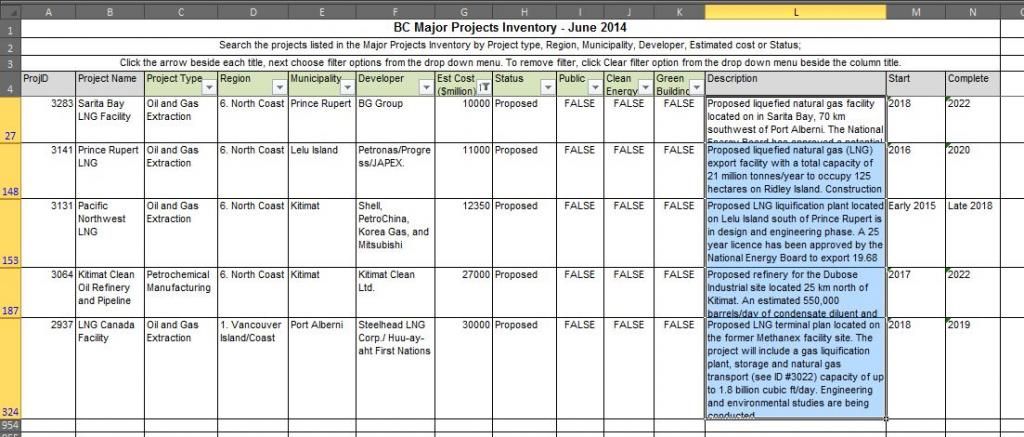

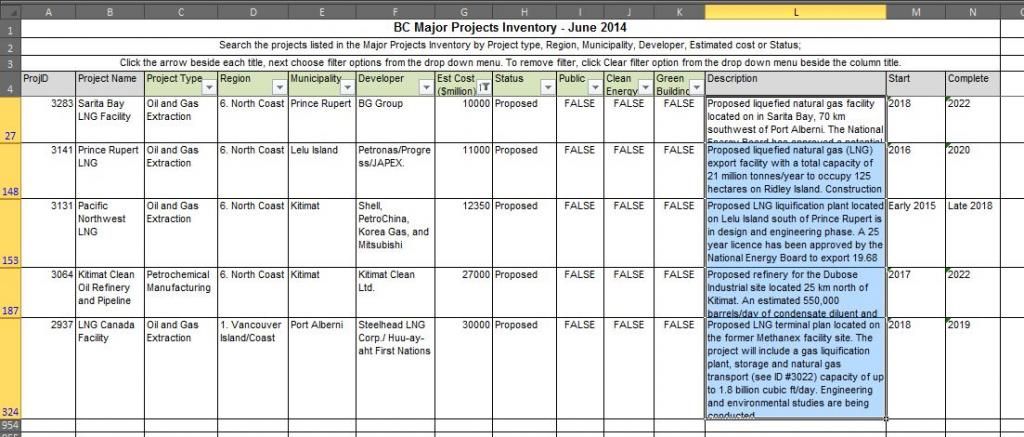

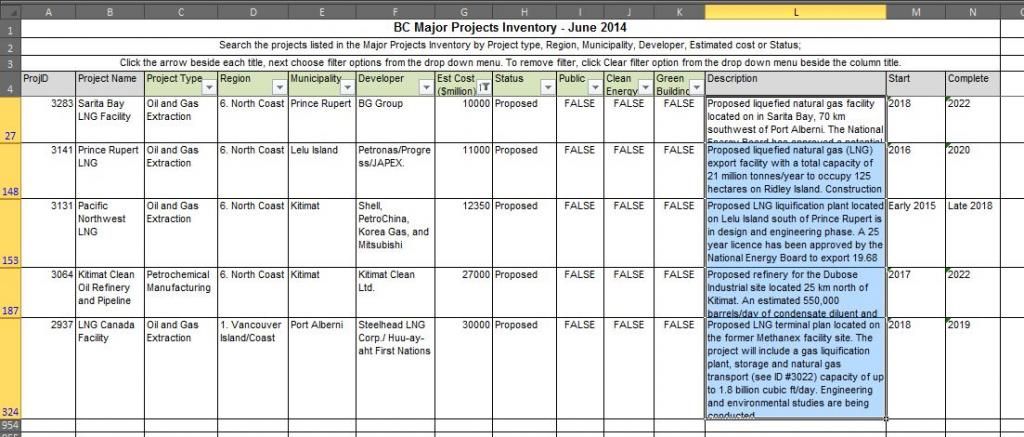

Originally Posted by Carl Johnson  It is not just keystone of course. The prospect for B.C. to be a major exporter of LNG is going to be a pipe-dream as well if price stay at current level for a year or two. | Well there are some out there hedging their bets that LNG is going to quickly come to represent 20-30 percent of BC's GDP.

Steel Head LNG alone represents a gross capital expenditure of over 30 billion dollars before it ever even fires up for the first time.

In fact 4 of the 5 biggest projects outlined in BC's major projects index are LNG.

For the lazy here is a screen capture:  |

|  |  01-06-2015, 11:02 PM

01-06-2015, 11:02 PM

|

#92 | | I WANT MY 10 YEARS BACK FROM RS.net!

Join Date: Oct 2007 Location: Vancouver BC

Posts: 22,174

Thanked 9,971 Times in 3,950 Posts

Failed 881 Times in 421 Posts

|

gas worked out to be 63 cents/L at blaine WA couple days ago (dipped below $2USD/gal)

not sure if I should be scared or happy  |

|  |  01-06-2015, 11:17 PM

01-06-2015, 11:17 PM

|

#93 | | I only answer to my username, my real name is Irrelevant!

Join Date: Oct 2002 Location: CELICAland

Posts: 25,688

Thanked 10,397 Times in 3,920 Posts

Failed 1,390 Times in 625 Posts

|

it's $0.60+ cents in Edmonton too

|

|  |  01-06-2015, 11:20 PM

01-06-2015, 11:20 PM

|

#94 | | I wish I was where I was when I wished I was here

Join Date: Feb 2010 Location: West Coast

Posts: 4,932

Thanked 3,098 Times in 733 Posts

Failed 703 Times in 219 Posts

|

1.18 USD to 1.00 CDN today...

__________________

--------------------------

Cadillac CTS (Current) |

|  |  01-06-2015, 11:55 PM

01-06-2015, 11:55 PM

|

#95 | | RS.net, where our google ads make absolutely no sense!

Join Date: Nov 2001 Location: Tokyo/Vancouver

Posts: 982

Thanked 131 Times in 61 Posts

Failed 6 Times in 4 Posts

|

my guess, no fact, just opinion is

With the saudi/us effort to drive down oil prices is more to hurt the russian economy. the russian's being militant and aggressive the past year and a bit with a strong economy, whats the best way to tone that aggression down indirectly hurt their economy.

anyways from a canadian perspective, everything the gov't both federal and provincial is banking on is high oil prices, so all their budgets will not be balanced for the next little while. Coupled with a big no to the pipeline by Obama, expect the cdn dollar to sit around the 0.76-0.84 zone for sometime.

the low exchange has given the boc room to raise interest rates now though, which would push up the dollar a bit. i'd say 0.5 to 0.75 is possible in this year.

so low oil prices is a good and bad thing.

good for businesses that export,

good for reducing daily costs for people

bad for variable mortgages,

bad for holidays and shopping in the usa,

bad for imports,

and bad for the oil industry which in turn is bad for alberta and potentially BC for LNG

|

|  |  01-07-2015, 08:48 AM

01-07-2015, 08:48 AM

|

#96 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

| Quote:

Originally Posted by meme405  Well there are some out there hedging their bets that LNG is going to quickly come to represent 20-30 percent of BC's GDP.

Steel Head LNG alone represents a gross capital expenditure of over 30 billion dollars before it ever even fires up for the first time.

In fact 4 of the 5 biggest projects outlined in BC's major projects index are LNG.

For the lazy here is a screen capture:  | counting your eggs before they hatch? as far as i know, no major oil companies have announced any final investment decision yet. Both Petronas and BG Group have postponed their investment, and that was when oil was in the 70-80 range. the proponents of the LNG will throw around gargantuan numbers like 30 billion or 50 billion when in fact no companies have made their final decision to proceed with these costly projects.

it is ludicrous so say this virtually non-existent industry will represent almost 1/4 of this provinces' GDP. i am not even going to argue with you how dangerous and reckless this situation is if it becomes reality (i don't believe so). however there are so many unforeseeable variables that could happen like the oil collapse, it appears the bulls are just blinded for all the positives while ignoring the fundamentals. notwithstanding the economic challenges facing the nascent BC LNG industry, there is also growing challenges from U.S. on this front as well, just take a look at Oregon.

|

|  |  01-07-2015, 09:09 AM

01-07-2015, 09:09 AM

|

#97 | | 14 dolla balla aint got nothing on me!

Join Date: Nov 2006 Location: Vancouver

Posts: 635

Thanked 71 Times in 40 Posts

Failed 13 Times in 8 Posts

| Quote:

Originally Posted by Traum  If oil prices remain low, and Russia continues to try and back the Ruble without making huge concessions on Ukraine, they are not going to last long. They will run out of foreign reserves, and then the Russian national finance system as well as their economy will collapse. Along with it, the Russian state will probably face a huge risk of collapsing as well.

Naturally, the smartest thing Putin could do is to pull out of Ukraine, and tell the Russian government to do nothing and just let the Ruble depreciate. Yes, the Ruble will be hit hard, and Russia will face a harsh recession for a few years. But at least they can preserve their foreign reserves for things and situations that are really necessary, and a low Ruble along with assistance from RoW could help their non-oil-related export sector rebound.

Given Putin's nature and ego, however, I totally doubt he will go along with the above plan at this point. This tyrant values his face and ego more than a lot of other things. | I just began learning how forex works but correct me if I am wrong. If ruble is keep depreciating, shouldn't the Russian Government use even more foreign reserve to import the same amount of goods ??

|

|  |  01-07-2015, 10:32 AM

01-07-2015, 10:32 AM

|

#98 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 39,479

Thanked 16,089 Times in 6,561 Posts

Failed 2,165 Times in 747 Posts

|

Live in BC, own a property, never go to the states.

Dollar up, dollar down, it's allllll the sameeee

__________________

Dank memes cant melt steel beams

|

|  |  01-07-2015, 10:39 AM

01-07-2015, 10:39 AM

|

#99 | | RS has made me the bitter person i am today!

Join Date: Feb 2013 Location: Vancouver

Posts: 4,891

Thanked 7,790 Times in 2,326 Posts

Failed 409 Times in 181 Posts

| Quote:

Originally Posted by Carl Johnson  counting your eggs before they hatch? as far as i know, no major oil companies have announced any final investment decision yet. Both Petronas and BG Group have postponed their investment, and that was when oil was in the 70-80 range. the proponents of the LNG will throw around gargantuan numbers like 30 billion or 50 billion when in fact no companies have made their final decision to proceed with these costly projects.

it is ludicrous so say this virtually non-existent industry will represent almost 1/4 of this provinces' GDP. i am not even going to argue with you how dangerous and reckless this situation is if it becomes reality (i don't believe so). however there are so many unforeseeable variables that could happen like the oil collapse, it appears the bulls are just blinded for all the positives while ignoring the fundamentals. notwithstanding the economic challenges facing the nascent BC LNG industry, there is also growing challenges from U.S. on this front as well, just take a look at Oregon. | I'm not counting any eggs you clown.

Calm your tits. It's a good thing that I didn't say shit about believing in the LNG hype, but our government has bought into it. So you're only arguing with yourself.

And although LNG hasn't yet taken off here. It is quickly burgeoning in other countries. There is a demand for the product, it's all about who can fill that need at the lowest price, while still turning a profit. The environmentalists here make it almost impossible for us to do this on the cheap (not complaining but it's a fact).

|

|  |  01-07-2015, 01:12 PM

01-07-2015, 01:12 PM

|

#100 | | WOAH! i think Vtec just kicked in!

Join Date: Oct 2005 Location: Vancouver

Posts: 1,650

Thanked 348 Times in 165 Posts

Failed 127 Times in 56 Posts

| Quote:

Originally Posted by meme405  I'm not counting any eggs you clown.

Calm your tits. It's a good thing that I didn't say shit about believing in the LNG hype, but our government has bought into it. So you're only arguing with yourself.

And although LNG hasn't yet taken off here. It is quickly burgeoning in other countries. There is a demand for the product, it's all about who can fill that need at the lowest price, while still turning a profit. The environmentalists here make it almost impossible for us to do this on the cheap (not complaining but it's a fact). | Nothing like a good old price war paving the way to a successful business venture. *sarcasm off*

|

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 11:18 AM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

AP Photo/Pablo Martinez Monsivais, FileWhen even a Republican-dominated Senate can’t muster enough support to force the Barack Obama’s hand, it’s a sure sign that activist opponents of Keystone dominate the pipeline decision-making process.

AP Photo/Pablo Martinez Monsivais, FileWhen even a Republican-dominated Senate can’t muster enough support to force the Barack Obama’s hand, it’s a sure sign that activist opponents of Keystone dominate the pipeline decision-making process.