| Vancouver Off-Topic / Current Events The off-topic forum for Vancouver, funnies, non-auto centered discussions, WORK SAFE. While the rules are more relaxed here, there are still rules. Please refer to sticky thread in this forum. |

| |  12-16-2022, 08:54 AM

12-16-2022, 08:54 AM

|

#126 | | Willing to sell body for a few minutes on RS

Join Date: Oct 2016 Location: Ricemond

Posts: 10,481

Thanked 12,293 Times in 4,419 Posts

Failed 503 Times in 261 Posts

|

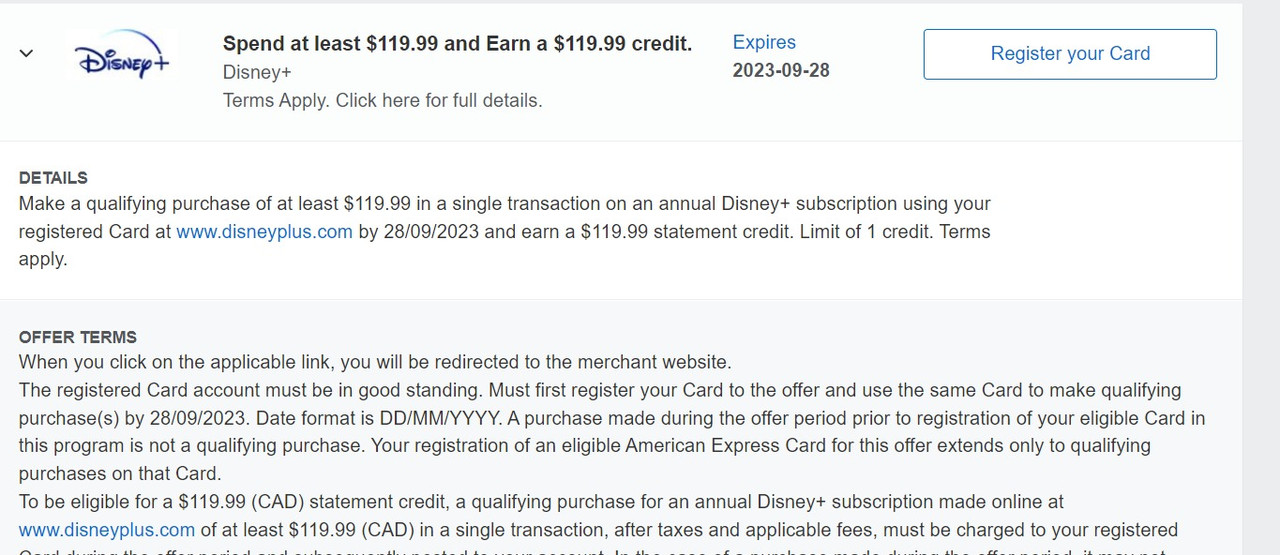

Check your amex accounts boys. I just looked on my account today and they had this free offer for disney plus.

well not totally free.. you gotta pay like 20 bucks worth of taxes and fees because it works out to 134 bucks and they only give you back 119.  |

|  |  12-16-2022, 09:03 AM

12-16-2022, 09:03 AM

|

#127 | | RS Veteran

Join Date: Dec 2001 Location: GTA

Posts: 30,500

Thanked 12,310 Times in 5,049 Posts

Failed 472 Times in 308 Posts

|

Yes, I got the offer but Disney+ is free for me for 12 months because of my internet package.

__________________ Quote:

Originally Posted by Badhobz  I think she’s one of those weirdos who gets off on feeding fat fucks. Pretty sure she feeds me and then goes home to cook her own baooo yuuu with supreme sauce | Quote:

Originally Posted by RabidRat  I had a takeout container leak greasy meat juice all over the passenger seat today. It was so much that it pooled up lol | |

|  |  12-18-2022, 07:56 PM

12-18-2022, 07:56 PM

|

#128 | | RS controls my life!

Join Date: Feb 2005 Location: Vancouver

Posts: 765

Thanked 70 Times in 27 Posts

Failed 3 Times in 3 Posts

| Quote:

Originally Posted by Badhobz  Check your amex accounts boys. I just looked on my account today and they had this free offer for disney plus.

well not totally free.. you gotta pay like 20 bucks worth of taxes and fees because it works out to 134 bucks and they only give you back 119.  | Damnit, there was an offer a couple of months back for half off Disney plus and I signed up for that.

Here's my lineup for cards:

AMEX - HOTEL - Marriot Bonvoy (annual $120) - 5x points on Marriot properties, 2x on everything else, free hotel night per year (up to 35k), Silver status (somewhat late checkouts, and bonus points/gifts, free WIFI)

VISA - FLIGHTS - Scotiabank Passport Visa Infinite Card (annual $150) - 3x points at Safeway, Sobeys, IGA, 2x points dine in/take out, rideshare, movies, 1x everything else, 6 lounges passes a year, no FX fees

MAST - BACKUP - Rogers World Elite Mastercard (annual $0) - 1.5% unlimited cash-back rewards on all eligible regular purchases, 3% unlimited cash-back rewards on all eligible purchases made in U.S. dollars

Last edited by l2_narain; 12-18-2022 at 08:08 PM.

|

|  |  01-15-2023, 01:59 PM

01-15-2023, 01:59 PM

|

#129 | | Banned (ABWS)?

Join Date: Oct 2004 Location: Vancouver

Posts: 19,372

Thanked 4,074 Times in 1,742 Posts

Failed 434 Times in 211 Posts

|

If I'm requesting a credit card limit increase through the website, it asks me to put in a number between $100 - 99,900.

Is there a rule of thumb of how much I should put in, or just put in $99,900 and they'll give me the max amount they're willing? Or will that just give me an auto rejection?

|

|  |  01-15-2023, 02:42 PM

01-15-2023, 02:42 PM

|

#130 | | Willing to sell body for a few minutes on RS

Join Date: Oct 2016 Location: Ricemond

Posts: 10,481

Thanked 12,293 Times in 4,419 Posts

Failed 503 Times in 261 Posts

|

I wouldn’t put in that much unless you know you’re gonna spend that amount. They might ding your credit and you seem like a “credit seeker”.

|

|  |  01-15-2023, 03:33 PM

01-15-2023, 03:33 PM

|

#131 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Feb 2002 Location: Vancouver

Posts: 8,372

Thanked 4,001 Times in 1,545 Posts

Failed 35 Times in 27 Posts

|

Out as much as you need. Taking note that any amount approved will take away from your ability for a loan. It’s a liability. Mortgage etc.

__________________

Crush - 1971 Datsun 240z - Build Thread

The Daily - Rav4 V6 - “Goldilocks”

|

|  |  01-15-2023, 03:52 PM

01-15-2023, 03:52 PM

|

#132 | | Banned (ABWS)?

Join Date: Oct 2004 Location: Vancouver

Posts: 19,372

Thanked 4,074 Times in 1,742 Posts

Failed 434 Times in 211 Posts

| Quote:

Originally Posted by Badhobz  I wouldn’t put in that much unless you know you’re gonna spend that amount. They might ding your credit and you seem like a “credit seeker”. | I was just trying to lower my utilization rate, but it's more of a want, not really a need. So I guess I won't bother with an increase then.

|

|  |  01-15-2023, 04:03 PM

01-15-2023, 04:03 PM

|

#133 | | RS has made me the bitter person i am today!

Join Date: Apr 2003 Location: Vancouver

Posts: 4,865

Thanked 1,057 Times in 429 Posts

Failed 178 Times in 73 Posts

|

I usually ask for double what my previous limit used to be. But i get what your saying though. If you could get 100k limit then why not right? But i usually forget that the majority of this population have no self control on spending. Which is probably why they ask.

Im gonna say that your credit limit amount doesnt affect your ability to get a loan. If u have money oweing then of course.

|

|  |  01-15-2023, 04:34 PM

01-15-2023, 04:34 PM

|

#134 | | Willing to sell body for a few minutes on RS

Join Date: Oct 2016 Location: Ricemond

Posts: 10,481

Thanked 12,293 Times in 4,419 Posts

Failed 503 Times in 261 Posts

| Quote:

Originally Posted by AzNightmare  I was just trying to lower my utilization rate, but it's more of a want, not really a need. So I guess I won't bother with an increase then. | yeah be careful of these credit card companies. some give out insanely high limits (looking at you amex) and then it takes away from your ability to secure higher mortgages later on.

|

|  |  01-15-2023, 04:41 PM

01-15-2023, 04:41 PM

|

#135 | | RS Veteran

Join Date: Dec 2001 Location: GTA

Posts: 30,500

Thanked 12,310 Times in 5,049 Posts

Failed 472 Times in 308 Posts

|

Ditto on which credit card companies you are looking to increase your credit limit to. AMEX is notorious for being overly generous with giving out credit limit increases.

One example of this is last year I got married and managed to put a majority of our expenses onto our AMEX which (for us) was great. We knew what we were going to spend and how to manage the expenses carefully. If it weren't for the wedding, we wouldn't have gotten the credit limit increase. No mortgage or loan-related stuff until a year or two later so this was a pre-calculated decision.

This year, we plan on doing some major renovations to our place so whatever expenses we can put on to our AMEX, we will, while having the ability to pay for it all with cash reserve we've managed to save up for. Assuming the renovations don't go over out budget, there should be no need for us to dip into our line-of-credit / HELOC or request any additional funding for this endeavor to work against our credit.

__________________ Quote:

Originally Posted by Badhobz  I think she’s one of those weirdos who gets off on feeding fat fucks. Pretty sure she feeds me and then goes home to cook her own baooo yuuu with supreme sauce | Quote:

Originally Posted by RabidRat  I had a takeout container leak greasy meat juice all over the passenger seat today. It was so much that it pooled up lol | |

|  |  01-16-2023, 09:12 AM

01-16-2023, 09:12 AM

|

#136 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,038

Thanked 2,758 Times in 1,070 Posts

Failed 256 Times in 73 Posts

|

Aventura has a sick churn the last few weeks, it was for 40K-45K points which is roughly $500 to $562.50 in travel credits, aka book flight or expedia + cancel to get cash.

BMO also has $390 for new account within 2 years with GCR, not sure what rules on referrals are but there may be a additional bonus on that too.

Goal is to push an extra $2K in CC/Bank openings this year.

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

|

|  |  01-17-2023, 07:45 AM

01-17-2023, 07:45 AM

|

#137 | | RS has made me the bitter person i am today!

Join Date: Feb 2013 Location: Vancouver

Posts: 4,887

Thanked 7,783 Times in 2,324 Posts

Failed 409 Times in 181 Posts

| Quote:

Originally Posted by RiceIntegraRS  Im gonna say that your credit limit amount doesnt affect your ability to get a loan. If u have money oweing then of course. | This is absolutely incorrect, and dangerous advice to give to someone who doesnt know any better.

If you have a 100k worth of credit on multiple cards, this can absolutely lower how much of a mortgage you can get, as the bank will have to factor your ability to max those cards along with your total mortgage amount. At the end of the day the total calculation revolves around how much damage can you create if you default, and if you have 200 or 300k worth of card limit, along with 1 mil of mortgage and you only make 100 a year, this is going to be a big problem for the bank.

There is a balance with everything, you dont want your credit cards to be maxed all the time because your limit is too low, as a high utilization even if you pay off the card every month can look bad to creditors. at the same time having a 100k limit and only using 1000 of it a month will also have negative problems.

There isn't a perfect balance, but I try to maintain 4-5 times my average month spending. This means that months that come along where I need to pay for Home Insurance or car insurance, or business expenses, that I can do so without worrying. But I dont carry 100k worth of limit needlessly. You can always also pay off portions of your card off throughout the month if you have a time where you need additional capacity.

|

|  |  01-17-2023, 09:38 AM

01-17-2023, 09:38 AM

|

#138 | | RS has made me the bitter person i am today!

Join Date: Dec 2002 Location: YVR/TPE

Posts: 4,881

Thanked 2,964 Times in 1,280 Posts

Failed 652 Times in 209 Posts

| Quote:

Originally Posted by meme405  This is absolutely incorrect, and dangerous advice to give to someone who doesnt know any better.

If you have a 100k worth of credit on multiple cards, this can absolutely lower how much of a mortgage you can get, as the bank will have to factor your ability to max those cards along with your total mortgage amount. At the end of the day the total calculation revolves around how much damage can you create if you default, and if you have 200 or 300k worth of card limit, along with 1 mil of mortgage and you only make 100 a year, this is going to be a big problem for the bank.

There is a balance with everything, you dont want your credit cards to be maxed all the time because your limit is too low, as a high utilization even if you pay off the card every month can look bad to creditors. at the same time having a 100k limit and only using 1000 of it a month will also have negative problems.

There isn't a perfect balance, but I try to maintain 4-5 times my average month spending. This means that months that come along where I need to pay for Home Insurance or car insurance, or business expenses, that I can do so without worrying. But I dont carry 100k worth of limit needlessly. You can always also pay off portions of your card off throughout the month if you have a time where you need additional capacity. | Second this.

To be honest, I don't know about you guys, but I used fight my ways to lower my CC limits. What I usually do is 2-2.5x of my usual spending, and only 1 card with very high limits that used for those occasions that I need to buy something big and can totally use the perks on that high expense card.

Of course now that me and my wife consolidated everything onto 1 single card, that advise might seem pointless. But that's only because I've grown to have great control on budgeting and expenses and that soft-limit is no longer necessary.

__________________

Nothing for now

|

|  |  01-17-2023, 11:06 AM

01-17-2023, 11:06 AM

|

#139 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Feb 2002 Location: Vancouver

Posts: 8,372

Thanked 4,001 Times in 1,545 Posts

Failed 35 Times in 27 Posts

|

How many cards do you guys have?

My wife and I share one, which we do all our spending. She has a spare, and I don’t. Although I feel I should have a backup.

__________________

Crush - 1971 Datsun 240z - Build Thread

The Daily - Rav4 V6 - “Goldilocks”

|

|  |  01-17-2023, 11:29 AM

01-17-2023, 11:29 AM

|

#140 | | My homepage has been set to RS

Join Date: Apr 2004 Location: Vancouver

Posts: 2,300

Thanked 1,448 Times in 569 Posts

Failed 40 Times in 21 Posts

| Quote:

Originally Posted by hud 91gt  How many cards do you guys have?

My wife and I share one, which we do all our spending. She has a spare, and I don’t. Although I feel I should have a backup. | Absolutely you should have another. If not for anything else but to help building your credit score.

Although not often, but some places only take Visa or Mastercard or vice versa. Then there are the different levels of cash-back or rewards available on each card. Card for gas you max CB, card for travel to max points and insurance, etc etc.

|

|  |  01-17-2023, 12:32 PM

01-17-2023, 12:32 PM

|

#141 | | RS has made me the bitter person i am today!

Join Date: Mar 2006 Location: Vancouver

Posts: 4,786

Thanked 3,503 Times in 1,634 Posts

Failed 63 Times in 38 Posts

|

1 MC and 1 Visa that I use regularly.

The Costco MC is our joint expenses card, taken out under my name.

The Visa is TD Infinite cash back.

I think the TD is ~20k limit right now the Costco card $8k

I also have another MC that just sits and doesn't get used. Too much hassle to try and close it and it's got a small limit anyways. When we were doing our mortgage, CC limit was not really a question but rather they cared that we paid off that months CC bill at the time of application. I'm not sure how big of a difference it makes but it was a thing repeatedly.

|

|  |  01-17-2023, 01:07 PM

01-17-2023, 01:07 PM

|

#142 | | 2013, 2016, 2017 & 2018 NHL Fantasy RS1 Champion

Join Date: Aug 2005 Location: Vancouver

Posts: 7,128

Thanked 1,315 Times in 610 Posts

Failed 65 Times in 37 Posts

|

3 Amex (Plat, Biz Gold and Cobalt)

2 MC (MBNA CB to keep credit & MBNA AS until they cancel it)

1 Visa (TD AP Privilege)

2 US cards (Amex Hilton and Chase Sapphire Preferred)

|

|  |  01-17-2023, 01:19 PM

01-17-2023, 01:19 PM

|

#143 | | RS.net, helping ugly ppl have sex since 2001

Join Date: Feb 2002 Location: Vancouver

Posts: 8,372

Thanked 4,001 Times in 1,545 Posts

Failed 35 Times in 27 Posts

|

Might have to start calling you Costanza! Lol

__________________

Crush - 1971 Datsun 240z - Build Thread

The Daily - Rav4 V6 - “Goldilocks”

|

|  |  01-17-2023, 01:49 PM

01-17-2023, 01:49 PM

|

#144 | | RS Veteran

Join Date: Dec 2001 Location: GTA

Posts: 30,500

Thanked 12,310 Times in 5,049 Posts

Failed 472 Times in 308 Posts

|

Surprised nobody has said they have an AMEX Black card, yet. (Maybe secretly HonesTea does)

__________________ Quote:

Originally Posted by Badhobz  I think she’s one of those weirdos who gets off on feeding fat fucks. Pretty sure she feeds me and then goes home to cook her own baooo yuuu with supreme sauce | Quote:

Originally Posted by RabidRat  I had a takeout container leak greasy meat juice all over the passenger seat today. It was so much that it pooled up lol | |

|  |  01-17-2023, 03:48 PM

01-17-2023, 03:48 PM

|

#145 | | OMGWTFBBQ is a common word I say everyday

Join Date: Jul 2006 Location: Vancouver

Posts: 5,437

Thanked 3,161 Times in 1,341 Posts

Failed 46 Times in 26 Posts

|

How did you get the US cards?

__________________ Quote:

Originally Posted by PeanutButter  Damn, not only is yours veiny AF, yours is thick AF too. Yours is twice as thick as mine.. That looks like a 2" or maybe even 3"? | |

|  |  01-17-2023, 04:31 PM

01-17-2023, 04:31 PM

|

#146 | | RS has made me the bitter person i am today!

Join Date: Feb 2013 Location: Vancouver

Posts: 4,887

Thanked 7,783 Times in 2,324 Posts

Failed 409 Times in 181 Posts

|

I would definitely suggest having 2 cards, as one can become compromised, lost, or i've actually had a card where it just stopped working (like the physical chip/mag strip).

I have a Visa and a MC.

Only other card I have is a basic US dollars MC for if I travel in the states or want to buy something off an american website.

I dont see the need or the want for 9 cards, I know plenty of people who hop around on cards trying to maximize benefits and loyalty points and shit, all I can say is you guys have too much free fucking time.

EDIT: also with the change that is coming with CC processing fees being charged to the customer at some retailers, the loyalty card thing is likely to start becoming less prevalent.

|

|  |  01-17-2023, 04:37 PM

01-17-2023, 04:37 PM

|

#147 | | 2013, 2016, 2017 & 2018 NHL Fantasy RS1 Champion

Join Date: Aug 2005 Location: Vancouver

Posts: 7,128

Thanked 1,315 Times in 610 Posts

Failed 65 Times in 37 Posts

| Quote:

Originally Posted by roastpuff  How did you get the US cards? | You either need a ITIN or a SSN to apply. https://princeoftravel.com/guides/ge...for-canadians/ has some good information on it.

Once you get your first US card, start building credit and after 12-24 months, apply for Chase.

|

|  |  01-17-2023, 04:58 PM

01-17-2023, 04:58 PM

|

#148 | | OMGWTFBBQ is a common word I say everyday

Join Date: Nov 2010 Location: /

Posts: 5,038

Thanked 2,758 Times in 1,070 Posts

Failed 256 Times in 73 Posts

|

I'm currently using

Rogers MC 1.5% Cashback / 3% FX Daily for MC

Avion - Daily for Visa

- Cancelling as soon as my trip to Asia/MontrealF1 is over for travel insurance / flight insurance + transfer points out

Tangerine - 2% Gas/Restaurants - Should cancel too, I think cobalt is everyone's replacement for the optimal cash back for groceries, gas and restaurants?

Aventura - Churning, replacing with westjet MC shortly

__________________

2022 Velo N

2005 S2000

2007 CSX Type-S [Sold]

2002 RSX-S [T-Boned]

|

|  |  01-17-2023, 07:41 PM

01-17-2023, 07:41 PM

|

#149 | | I have named my kids VIC and VLS

Join Date: Oct 2001

Posts: 38,673

Thanked 15,540 Times in 6,286 Posts

Failed 2,132 Times in 726 Posts

|

If I didn’t hate WJ so much and their garbage planes I’d be tempted to switch

__________________

Dank memes cant melt steel beams

|

|  |  01-17-2023, 07:45 PM

01-17-2023, 07:45 PM

|

#150 | | RS has made me the bitter person i am today!

Join Date: Apr 2003 Location: Vancouver

Posts: 4,865

Thanked 1,057 Times in 429 Posts

Failed 178 Times in 73 Posts

| Quote:

Originally Posted by meme405  This is absolutely incorrect, and dangerous advice to give to someone who doesnt know any better.

If you have a 100k worth of credit on multiple cards, this can absolutely lower how much of a mortgage you can get, as the bank will have to factor your ability to max those cards along with your total mortgage amount. At the end of the day the total calculation revolves around how much damage can you create if you default, and if you have 200 or 300k worth of card limit, along with 1 mil of mortgage and you only make 100 a year, this is going to be a big problem for the bank.

There is a balance with everything, you dont want your credit cards to be maxed all the time because your limit is too low, as a high utilization even if you pay off the card every month can look bad to creditors. at the same time having a 100k limit and only using 1000 of it a month will also have negative problems.

There isn't a perfect balance, but I try to maintain 4-5 times my average month spending. This means that months that come along where I need to pay for Home Insurance or car insurance, or business expenses, that I can do so without worrying. But I dont carry 100k worth of limit needlessly. You can always also pay off portions of your card off throughout the month if you have a time where you need additional capacity. |

So i read this in the morning and decided to msg my mortgage broker who just did my renewal a few weeks ago and another friend who is also a broker. They both said your credit limit doesnt affect your ability to get a loan. In those rare cases where the borrower is basically on the edge of getting approved or not, they will be asked to decrease their credit limit.

You can believe me or not, i think everyone knows a broker or someone that works with a lender that can answer this question for u

|

|  |  | |

Posting Rules

Posting Rules

| You may not post new threads You may not post replies You may not post attachments You may not edit your posts

HTML code is Off

| | |

All times are GMT -8. The time now is 06:12 PM.

|

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our free community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

The banners on the left side and below do not show for registered users!